What Is DeFi and How Does It Work? A Clear Guide

Category: Cryptocurrency

Unlocking DeFi: What It Is and How It Works

If you're a cryptocurrency enthusiast or investor—from curious beginner to seasoned trader—chances are you've heard the term DeFi thrown around, but might wonder exactly what it means and how it truly functions. Decentralized Finance, or DeFi, represents a revolutionary shift in how financial services operate, removing intermediaries and enabling anyone with an internet connection to lend, borrow, trade, and earn interest directly through blockchain protocols. You’ve likely found this post because you want a straightforward, no-fluff explanation that goes beyond buzzwords and technical jargon; something that not only defines DeFi but also reveals the mechanics powering its rapid growth and why it matters to your crypto journey. This guide is crafted to fill that gap. We’ll walk you through DeFi’s core concepts, underlying technology, key platforms, benefits, risks, and its evolving landscape with clarity and insight—no matter your experience level. By the end, you’ll grasp how DeFi opens new opportunities for financial freedom and innovation, equipping you to make smarter decisions whether you’re investing in altcoins, diversifying a Bitcoin portfolio, or considering blockchain-based earning strategies. Dive in to discover how DeFi works and why it’s reshaping the future of finance in ways you can engage with today.

- Unlocking DeFi: What It Is and How It Works

- Overview of DeFi: Definition, Origins, and How It Contrasts with Traditional Finance

- Core Technologies Behind DeFi: Blockchain, Smart Contracts, and Decentralized Applications (dApps)

- How DeFi Works: Step-by-Step Flow of Lending, Borrowing, Trading, and Yield Farming

- Popular DeFi Platforms and Protocols: Detailed Examples Like Uniswap, MakerDAO, Aave, and Compound

- Benefits of DeFi: Transparency, Accessibility, Reduced Intermediaries, and Permissionless Finance

- Risks and Challenges in DeFi: Security Vulnerabilities, Regulatory Concerns, and Market Volatility

- DeFi Tokens and Governance: Understanding Native Tokens, Governance Models, and User Participation

- DeFi Use Cases: Real-World Implications Across Finance Sectors

- Comparing DeFi with CeFi (Centralized Finance): Key Differences and When to Use Each

- Future Trends in DeFi: Emerging Innovations, Scalability Solutions, and Integration with Traditional Finance

Overview of DeFi: Definition, Origins, and How It Contrasts with Traditional Finance

Decentralized Finance (DeFi) is an innovative financial ecosystem built on blockchain technology that eliminates the need for centralized intermediaries like banks, brokers, or payment processors. Unlike traditional finance systems, which rely on centralized authorities to verify and process transactions, DeFi leverages smart contracts—self-executing programs deployed on public blockchains such as Ethereum—to automate and enforce financial agreements transparently and trustlessly. This fundamental shift enables peer-to-peer financial interactions that are accessible globally, 24/7, with minimal friction and often lower fees.

The origins of DeFi can be traced back to the emergence of Bitcoin in 2009, which introduced the concept of decentralized peer-to-peer value transfer. However, the real acceleration came with Ethereum's launch in 2015, which added programmability via smart contracts. This allowed developers to create a wide array of financial applications—ranging from lending and borrowing platforms to decentralized exchanges (DEXs) and yield farming protocols—that operate without traditional middlemen.

In contrast to traditional finance (TradFi) systems, which are often constrained by geographic borders, regulatory gatekeepers, and lengthy approval processes, DeFi offers several key advantages:

- Permissionless Access: Anyone with an internet connection and a compatible wallet can participate without needing approval from a central authority.

- Transparency: Transaction data and contract code are publicly auditable on the blockchain, enhancing trust and security.

- Composability: DeFi protocols can interconnect and build on each other like “money legos,” creating an interoperable financial ecosystem.

- Censorship Resistance: DeFi applications are less prone to shutdowns or censorship since they operate on decentralized networks rather than centralized servers.

Understanding these distinctions is critical to appreciating how DeFi is redefining traditional financial services, making them more inclusive, efficient, and innovative for users around the world.

Image courtesy of Jonathan Borba

Core Technologies Behind DeFi: Blockchain, Smart Contracts, and Decentralized Applications (dApps)

At the heart of Decentralized Finance (DeFi) lies a trio of groundbreaking technologies that together enable a transparent, trustless, and open financial ecosystem: blockchain, smart contracts, and decentralized applications (dApps). Understanding these components is essential to grasp how DeFi platforms operate seamlessly without relying on banks or centralized intermediaries.

Blockchain: The Decentralized Ledger

DeFi is powered by blockchain technology, a distributed ledger that records every transaction across a network of computers (nodes). Unlike traditional databases controlled by a single entity, a blockchain is decentralized, immutable, and transparent — ensuring that all data is securely recorded and publicly verifiable. Ethereum is currently the most widely used blockchain for DeFi due to its support for programmable contracts and vibrant developer ecosystem. The decentralized nature of blockchain allows DeFi platforms to function continuously, free from censorship, downtime, or single points of failure, fostering trustless financial interactions worldwide.

Smart Contracts: Automated Trust and Execution

Smart contracts are self-executing code stored and run on the blockchain that automatically enforce the terms of financial agreements without human intervention. These programmable contracts trigger actions—like loan disbursement, collateral liquidation, or token swaps—when predefined conditions are met. This automation eliminates the need for manual processing or reliance on middlemen, dramatically reducing costs and turnaround times. The transparency and open-source nature of smart contracts also enable users and developers to audit the code, ensuring fairness and security. They are the backbone of DeFi, enabling everything from decentralized lending and borrowing to yield farming and automated market making.

Decentralized Applications (dApps): User Interfaces of DeFi

Built on top of blockchains and powered by smart contracts, decentralized applications (dApps) are software platforms that provide intuitive interfaces for users to access DeFi services. Unlike traditional apps hosted on centralized servers, dApps run on a peer-to-peer network, eliminating centralized control and points of vulnerability. Popular DeFi dApps include decentralized exchanges (DEXs) like Uniswap, lending platforms like Aave, and stablecoins like DAI. These dApps leverage blockchain’s transparency and smart contracts’ automation to offer permissionless and programmable financial products accessible to anyone worldwide with a wallet and internet connection.

Together, blockchain, smart contracts, and dApps create a powerful synergy that enables DeFi to deliver innovative, secure, and user-centric financial services. This technological foundation is what makes DeFi resilient, scalable, and capable of reshaping traditional finance by offering greater accessibility, efficiency, and control to users at all experience levels.

Image courtesy of Jonathan Borba

How DeFi Works: Step-by-Step Flow of Lending, Borrowing, Trading, and Yield Farming

DeFi’s magic lies in the seamless interplay of various financial activities powered by smart contracts and blockchain transparency. Let’s break down the core processes—lending, borrowing, trading, and yield farming—to understand how users interact with DeFi platforms and unlock financial opportunities without intermediaries.

1. Lending and Borrowing: Earning Interest and Accessing Liquidity

In DeFi lending protocols like Aave or Compound, users can deposit crypto assets into liquidity pools, which are governed by smart contracts. These pools serve as collective funds that other users can borrow from, typically by posting collateral to secure the loan.

- Lenders provide assets to liquidity pools and earn interest paid by borrowers.

- Borrowers lock collateral (often exceeding the borrowed amount to mitigate risk) to access instant loans without credit checks or bank approval.

- Smart contracts automatically calculate interest rates based on supply and demand, collateral ratios, and repay or liquidate loans if conditions aren’t met.

This automated, permissionless lending ecosystem turns idle holdings into income-generating assets while giving borrowers flexible liquidity options.

2. Trading on Decentralized Exchanges (DEXs)

Decentralized exchanges like Uniswap and SushiSwap enable users to swap tokens directly from their wallets without relying on centralized order books or intermediaries. Here’s how it works:

- Users connect their wallets to a DEX dApp.

- They select the trading pair, for example, swapping Ethereum (ETH) for a stablecoin like DAI.

- Smart contracts execute trades instantly by interacting with liquidity pools funded by other users.

- Prices are determined algorithmically through Automated Market Makers (AMMs), which balance supply and demand while continuously updating asset prices.

This peer-to-peer model offers greater transparency, reduced counterparty risk, and access to a vast range of crypto assets globally.

3. Yield Farming: Maximizing Returns Through Liquidity Provision

Yield farming, also known as liquidity mining, involves users locking or staking their crypto assets within DeFi protocols to earn additional rewards, often in the form of native tokens. The general flow includes:

- Depositing tokens into liquidity pools to help facilitate trading or lending.

- Earning interest, fees, or governance tokens as incentives for providing liquidity.

- Users can then reinvest rewards or swap them to diversify their holdings.

Yield farming strategies can be simple or complex, combining multiple protocols to maximize returns, but all rely on smart contracts to automate reward distribution and enforce rules without centralized oversight.

By enabling these core functions through smart contracts on open blockchains, DeFi radically redefines how individuals lend, borrow, trade, and earn yields—unlocking financial freedom and innovation that traditional finance systems struggle to match. With no gatekeepers, transparent mechanisms, and continuous accessibility, DeFi empowers anyone to engage actively with the crypto economy on their own terms.

Image courtesy of Alesia Kozik

Popular DeFi Platforms and Protocols: Detailed Examples Like Uniswap, MakerDAO, Aave, and Compound

To truly grasp how DeFi revolutionizes finance, it’s vital to explore some of the most widely adopted platforms and protocols that have shaped the space. These pioneering projects exemplify the power of decentralized applications (dApps) built on smart contracts, offering users diverse financial services without intermediaries. Let’s look at four cornerstone DeFi platforms—Uniswap, MakerDAO, Aave, and Compound—and understand how each operates and contributes to the broader ecosystem.

Uniswap: The Leading Decentralized Exchange (DEX)

Uniswap is one of the most popular Automated Market Maker (AMM) decentralized exchanges, enabling users to swap tokens directly from their wallets without order books or centralized control. Uniswap relies on liquidity pools provided by users who earn fees proportionally, creating a permissionless and efficient way to trade ERC-20 tokens. Its open and transparent protocol has become the backbone for countless token swaps and liquidity provision strategies, making it a key gateway for accessing the growing world of altcoins and DeFi tokens.

MakerDAO: A Protocol for Decentralized Stablecoins and Lending

MakerDAO established one of the earliest and most trusted DeFi systems by creating DAI, a decentralized stablecoin pegged to the US dollar. Users generate DAI by locking cryptocurrencies like Ethereum as collateral in Maker Vaults. This collateralized debt position (CDP) system allows users to borrow DAI against their crypto holdings, maintaining stability through algorithmic governance and collateral management. MakerDAO’s model provides a decentralized alternative to traditional stablecoins, empowering users with non-custodial loans and a robust stable-value currency for DeFi transactions.

Aave: Advanced Lending and Borrowing Protocol

Aave is a leading decentralized lending and borrowing platform known for its innovation, such as flash loans—instant, uncollateralized loans repaid within a single transaction. Users can deposit their crypto assets to earn variable or stable interest rates, while borrowers access liquidity by locking collateral. Aave supports a wide range of tokens and features advanced risk management tools, including flexible collateral options and interest rate switching, making it a favorite for users seeking both high liquidity and flexible borrowing conditions. Its transparent, non-custodial design exemplifies DeFi’s commitment to accessibility and security.

Compound: Algorithmic Money Markets for Crypto Assets

Compound provides a decentralized algorithmic interest rate protocol that enables asset lending and borrowing in a fully permissionless manner. Users supply cryptocurrencies to liquidity pools, earning interest that adjusts dynamically based on market demand. Borrowers lock collateral to borrow assets, with smart contracts ensuring automatic liquidation if collateral values fall below thresholds. Compound’s governance token (COMP) also incentivizes community participation in protocol upgrades and decisions, embodying the decentralized governance that defines many DeFi projects.

Together, these platforms highlight the diverse capabilities of DeFi, from seamless token exchange and decentralized stablecoins to innovative borrowing and lending solutions with flexible terms. They are not just individual services but interconnected building blocks that demonstrate how DeFi protocols work in harmony to democratize finance—offering unprecedented liquidity, transparency, and user control to the global crypto community.

Image courtesy of Jonathan Borba

Benefits of DeFi: Transparency, Accessibility, Reduced Intermediaries, and Permissionless Finance

Decentralized Finance (DeFi) is rapidly transforming the financial landscape by offering several key benefits that traditional finance struggles to match. At its core, DeFi provides unprecedented transparency, enhanced accessibility, and reduced reliance on intermediaries, creating a more inclusive and efficient financial ecosystem. Let’s explore these advantages in detail.

1. Transparency: Open and Auditable Financial Systems

One of DeFi’s most powerful features is its foundation on public blockchains, where all transactions and smart contract codes are fully transparent and verifiable. This open access to transaction histories and protocol logic enables users to audit how funds are managed, how interest rates are calculated, and how loans or trades are executed—something impossible with closed, centralized financial institutions. This transparency reduces the risk of fraud, manipulation, or hidden fees and fosters greater trust among users worldwide.

2. Accessibility: Financial Services for Everyone, Everywhere

Unlike traditional banks that require credit checks, geographic eligibility, or extensive paperwork, DeFi protocols are permissionless and borderless. Anyone with an internet connection and a compatible wallet can instantly access lending, borrowing, trading, or earning services without needing approval from banks or governments. This democratization of finance helps underserved populations gain entry to the global economy, bridging gaps caused by location, socioeconomic status, or lack of traditional banking infrastructure.

3. Reduced Intermediaries: Lower Costs and Faster Transactions

DeFi eliminates middlemen such as banks, brokers, or payment processors by leveraging smart contracts to automate financial services. This removal of intermediaries reduces transaction fees, accelerates settlement times, and minimizes human error or delays inherent in traditional finance. By cutting out these layers, DeFi offers users more control over their assets, reduces costs, and increases efficiency in activities like loan approvals, asset swaps, and interest distribution.

4. Permissionless Finance: User Empowerment and Innovation

DeFi’s permissionless nature means protocols operate without gatekeepers—no central authority governs who can participate or when services are available. This ensures 24/7 financial access and fosters continuous innovation, as developers worldwide can create interoperable solutions, integrate new features, or launch novel financial instruments without bureaucratic constraints. Users maintain custody of their funds, enhancing security and autonomy compared to custodial TradFi accounts.

By combining transparency, global accessibility, intermediary reduction, and permissionless operation, DeFi establishes a trustless yet reliable financial ecosystem that empowers users of all backgrounds. These benefits not only make DeFi attractive for crypto enthusiasts and investors but also highlight its potential to reshape the future of finance on a global scale.

Image courtesy of Jonathan Borba

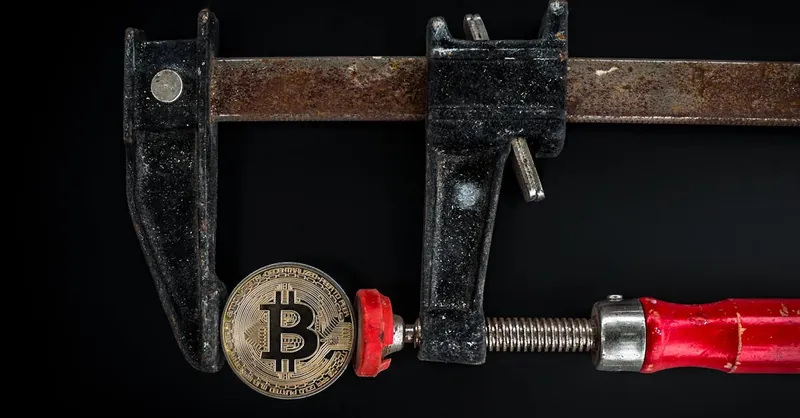

Risks and Challenges in DeFi: Security Vulnerabilities, Regulatory Concerns, and Market Volatility

While DeFi offers groundbreaking advantages like transparency, accessibility, and permissionless finance, it also introduces a unique set of risks and challenges that every user and investor should understand. Awareness of these factors is crucial for navigating the decentralized financial landscape safely and effectively.

1. Security Vulnerabilities: Smart Contract Risks and Hacks

DeFi protocols rely heavily on smart contracts, which are immutable once deployed but not immune to coding errors or exploits. Vulnerabilities in contract code can lead to significant financial losses, as malicious actors may exploit bugs to drain liquidity pools or manipulate protocol functions. Common security concerns include:

- Reentrancy attacks: Where attackers repeatedly call a function to drain funds before state updates occur.

- Flash loan exploits: Leveraging instant loans to manipulate asset prices or governance decisions.

- Poorly audited code: Many newer or smaller DeFi projects lack comprehensive third-party audits, increasing the chance of bugs.

Users must conduct due diligence by choosing audited, reputable protocols and staying updated on security developments in the DeFi ecosystem.

2. Regulatory Uncertainty: Evolving Legal Landscape

DeFi’s decentralized and permissionless nature presents challenges for regulators worldwide. The lack of central intermediaries raises questions around:

- Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

- Classification of DeFi tokens—whether they are securities, commodities, or utilities.

- Consumer protection and liability frameworks in the event of smart contract failures or fraud.

As governments increase scrutiny, regulatory changes could impact DeFi access, token listings, and protocol governance, potentially affecting user participation and innovation.

3. Market Volatility and Liquidity Risks

DeFi markets are inherently volatile due to the underlying nature of cryptocurrencies. Price fluctuations can lead to:

- Collateral liquidation risks: Borrowers may lose assets if their collateral value drops below required thresholds.

- Impermanent loss: Liquidity providers may experience losses compared to holding tokens outright due to price differences in pools.

- Rapid shifts in market sentiment causing liquidity crises, slippage, or sudden changes in interest rates.

Investors should carefully assess their risk tolerance, avoid over-leveraging, and diversify holdings to withstand market swings.

Understanding these security vulnerabilities, regulatory uncertainties, and market risks is vital for anyone engaging with DeFi platforms. While the potential rewards are significant, prudent risk management and continuous education remain the best defense against the inherent challenges within decentralized finance.

Image courtesy of Worldspectrum

DeFi Tokens and Governance: Understanding Native Tokens, Governance Models, and User Participation

A critical aspect of Decentralized Finance (DeFi) lies in its native governance tokens, which do far more than represent ownership—they empower users to actively participate in the decision-making processes of decentralized protocols. Unlike traditional finance, where key decisions are made by centralized entities and shareholders, many DeFi projects distribute governance power among token holders, enabling a truly decentralized and community-driven ecosystem.

Native DeFi Tokens: Utility and Incentives

DeFi tokens typically serve multiple functions within their protocols, such as:

- Governance: Token holders propose, debate, and vote on protocol upgrades, parameter changes, or fund allocations.

- Incentivization: Tokens reward users who contribute to the ecosystem by providing liquidity, staking assets, or participating in yield farming.

- Access and Fees: Some tokens grant usage rights or reduced fees within the protocol, aligning user incentives with network health.

For example, platforms like Compound distribute COMP tokens to users based on their participation, incentivizing liquidity provision while simultaneously enabling governance participation. Similarly, Uniswap’s UNI tokens give holders a voice over fee structures and liquidity incentives. This integration of utility and governance aligns individual rewards with the protocol’s long-term success.

Decentralized Governance Models: How Decisions Are Made

DeFi governance typically operates through Decentralized Autonomous Organizations (DAOs), where token holders engage in collective decision-making via on-chain voting mechanisms. Common governance features include:

- Proposal Submission: Any token holder or a qualified group can propose changes to the protocol.

- Voting Power: Proportional to the number of tokens held or staked, ensuring active contributors influence outcomes.

- Quorum and Timelocks: Thresholds for proposal approval and delay periods before execution to ensure transparency and security.

This structure enables dynamic evolution of protocols without relying on centralized teams, reducing risks of unilateral decisions, censorship, or stagnation. However, it also requires active community engagement and awareness to prevent governance attacks or undue influence by large token holders.

By understanding how native tokens drive both economic incentives and governance, users can better appreciate the empowering nature of DeFi ecosystems. This model fosters a participatory culture where holders are not just passive investors but active stakeholders shaping the future of the decentralized financial landscape. Engaging with DeFi governance offers a unique path to influence protocol development, advocate for improvements, and contribute to the sustainability and innovation of the broader crypto economy.

Image courtesy of Mikhail Nilov

DeFi Use Cases: Real-World Implications Across Finance Sectors

Decentralized Finance (DeFi) is not just a theoretical concept or niche crypto activity—it is rapidly transforming multiple real-world financial sectors by introducing permissionless, transparent, and automated alternatives to traditional services. These practical use cases showcase how DeFi’s blockchain-based infrastructure benefits users globally by providing faster, cheaper, and more inclusive financial products in areas such as payments, insurance, asset management, and synthetic assets.

1. Payments: Seamless, Borderless Transactions

DeFi facilitates instant, low-cost payments across borders without intermediaries like banks or payment processors. Stablecoins such as DAI or USDC play a crucial role here by maintaining value stability while enabling crypto payments. Users can send or receive funds worldwide 24/7, avoiding traditional delays, high fees, and currency exchange barriers. Additionally, decentralized payment protocols integrate with wallets and dApps to support micropayments, subscription services, or even payroll in cryptocurrency, broadening the scope and adoption of digital finance.

2. Insurance: Decentralized Risk Pooling and Claims

Traditional insurance often suffers from opacity, high premiums, and slow claims processing. In contrast, DeFi insurance platforms like Nexus Mutual leverage smart contracts to create decentralized risk pools funded by community members. These pools underwrite coverage for smart contract vulnerabilities, exchange hacks, or volatile market events. Policyholders benefit from increased transparency, fairer pricing, and faster payouts through automated claims execution. This innovative model can dramatically improve trust and efficiency in the insurance industry while democratizing access to coverage beyond conventional insurers.

3. Asset Management: Automated and Transparent Investments

DeFi also revolutionizes asset management by enabling automated portfolio strategies and decentralized fund management without intermediaries. Through algorithms encoded in smart contracts, users can participate in diversified investment pools, rebalance assets, or execute yield optimization strategies—often called Robo-advisors on the blockchain. Platforms like Yearn.finance aggregate user funds to maximize yield opportunities across protocols while maintaining full transparency of fees and performance. This democratization of asset management opens doors to previously inaccessible investment vehicles and enhances control and visibility for every participant.

4. Synthetic Assets: Expanding Access to Real-World Markets

Synthetic assets are digital representations of real-world assets—such as stocks, commodities, or indices—created on blockchain networks. DeFi protocols like Synthetix allow users to gain price exposure without owning the actual underlying asset, facilitating fractional ownership, 24/7 trading, and permissionless access. This capability helps bridge traditional financial markets and crypto ecosystems by enabling users worldwide to participate in diverse asset classes with blockchain-level security and transparency. Synthetic assets expand portfolio diversification while lowering entry barriers posed by geographic or regulatory restrictions.

These DeFi use cases highlight the profound real-world implications of decentralized finance technologies beyond cryptocurrency speculation. By improving payments, insurance, asset management, and synthetic asset exposure, DeFi offers a comprehensive, accessible alternative to legacy financial systems—driving greater financial inclusion, efficiency, and innovation for users across the globe.

Image courtesy of Jonathan Borba

Comparing DeFi with CeFi (Centralized Finance): Key Differences and When to Use Each

While Decentralized Finance (DeFi) champions trustless, permissionless access to financial services built on blockchain technology, Centralized Finance (CeFi) remains the familiar model where centralized institutions like banks, exchanges, or lending platforms control and manage users’ funds and services. Understanding the key differences between DeFi and CeFi is crucial for crypto users to make informed decisions about which system suits their needs best.

Key Differences Between DeFi and CeFi

- Control and Custody of Funds

- DeFi: Users retain full custody of their assets via private wallets, interacting directly with smart contracts without intermediaries. This reduces counterparty risk but requires personal responsibility for key management and security.

-

CeFi: Custody lies with centralized entities, which manage users’ funds on their behalf. While this offers convenience and customer support, it introduces risks like hacks, insolvency, or mismanagement.

-

Access and Permission

- DeFi: Anyone globally can access DeFi protocols without approval, making it truly permissionless and inclusive regardless of location or credit status.

-

CeFi: Requires user verification (KYC), compliance with regulations, and may impose geographic or asset restrictions, limiting accessibility.

-

Transparency and Trust

- DeFi: Operates with open-source smart contracts and public blockchains, providing complete transparency into transactions and protocol code. Trust is algorithmic and programmable.

-

CeFi: Relies on centralized governance; users must trust institutions to operate fairly without direct insight into internal processes or risks.

-

Speed and Costs

- DeFi: Transactions are automated but can be slower and more expensive during network congestion due to blockchain fees (e.g., gas on Ethereum).

-

CeFi: Typically offers faster transaction finality and may absorb operational costs but often charges fees for services and withdrawals.

-

Innovation and Flexibility

- DeFi: Rapidly evolving due to open protocol composability—users can combine multiple DeFi products to create customized strategies like yield farming or synthetic assets.

- CeFi: Innovation is slower, regulated, and controlled by the institution’s roadmap, often limiting product diversity and user control.

When to Use DeFi vs. CeFi

- Choose DeFi if you:

- Value full control over your crypto assets and custody.

- Seek borderless, permissionless financial services without approval delays.

- Want transparent, programmable protocols that enable innovative earning or borrowing strategies.

-

Are comfortable with managing wallet security and understanding smart contract risks.

-

Choose CeFi if you:

- Prefer a user-friendly interface with familiar customer support and dispute resolution.

- Want faster execution and are ok with traditional KYC and regulatory oversight.

- Deal with fiat on-ramps or off-ramps since CeFi platforms often integrate these more seamlessly.

- Need access to features like margin trading, lending in fiat, or stablecoin custody with less manual intervention.

In reality, many crypto users blend both systems to maximize benefits—using CeFi for convenience and stable fiat access, while leveraging DeFi for higher yields, access to new altcoins, and decentralized governance participation. Knowing the strengths and limitations of both DeFi and CeFi helps craft a balanced, strategic approach tailored to your goals, risk tolerance, and technical comfort level in the dynamic crypto landscape.

Image courtesy of Tima Miroshnichenko

Future Trends in DeFi: Emerging Innovations, Scalability Solutions, and Integration with Traditional Finance

As Decentralized Finance (DeFi) continues its rapid expansion, the ecosystem is evolving with groundbreaking innovations and technological advancements that promise to address current limitations and broaden its impact. Understanding these future trends in DeFi can help users and investors anticipate new opportunities and navigate the evolving landscape with confidence.

Emerging Innovations Driving DeFi's Next Phase

-

Layer 2 Scaling Solutions

Ethereum, the dominant platform for DeFi, often faces network congestion and high gas fees—barriers that Layer 2 (L2) protocols aim to overcome. Technologies such as Optimistic Rollups, zk-Rollups, and sidechains significantly increase transaction throughput and reduce costs by processing operations off-chain before settling on Ethereum’s mainnet. This scalability boost not only improves user experience but also enables DeFi to handle mass adoption and complex financial instruments without sacrificing decentralization or security. -

Cross-Chain Interoperability

Another key innovation is enhanced interoperability between blockchains. DeFi platforms are increasingly adopting cross-chain bridges and protocols that facilitate asset transfers and communication across different networks (e.g., Ethereum, Binance Smart Chain, Solana, Avalanche). This interoperability enables users to access a wider variety of tokens, liquidity pools, and services, creating an interconnected multi-chain DeFi ecosystem that breaks down silos and expands financial accessibility. -

Decentralized Identity and Privacy Solutions

To tackle concerns around user privacy and regulatory compliance, new DeFi projects are integrating decentralized identity (DID) frameworks and zero-knowledge proofs. These innovations allow users to verify credentials or creditworthiness without revealing sensitive personal data, fostering privacy-preserving yet compliant financial interactions. Such tech could enable DeFi protocols to gain regulatory acceptance while maintaining the trustless and permissionless ethos.

Integration with Traditional Finance (TradFi)

The boundary between DeFi and traditional finance is gradually blurring as institutions recognize DeFi’s potential for efficiency and innovation. Several trends highlight this growing synergy:

- Institutional Adoption: Major financial firms, asset managers, and funds are beginning to experiment with DeFi products for yield generation, liquidity provision, and asset tokenization. This influx of institutional capital can boost liquidity and credibility, helping stabilize DeFi markets.

- Tokenization of Real-World Assets: DeFi protocols are increasingly enabling the creation of blockchain-based representations of stocks, bonds, real estate, and commodities. This tokenization opens new avenues for fractional ownership, liquidity, and accessibility within traditional asset classes.

- Hybrid Regulatory Frameworks: Emerging regulatory approaches are seeking to integrate DeFi with compliant infrastructures through frameworks that balance innovation with investor protection. This evolving regulatory clarity may lead to mainstream DeFi adoption without compromising decentralization principles.

By combining cutting-edge scaling technologies, cross-chain composability, and collaborative Bridges to TradFi, future DeFi developments will overcome current bottlenecks and foster a more inclusive, efficient, and sophisticated financial ecosystem. Staying informed about these trends equips users to capitalize on new DeFi opportunities and participate actively in shaping the next generation of decentralized finance.

Image courtesy of Morthy Jameson