Smart Crypto Portfolio Diversification Tips for Every Investor

Category: Cryptocurrency

Master Cryptocurrency Portfolio Diversification Today

Diving into the world of cryptocurrency investing can be thrilling yet complex, especially when it comes to managing your portfolio. Whether you're a Bitcoin veteran experimenting with altcoins or a newcomer eager to minimize risk, understanding crypto portfolio diversification is crucial. You've likely searched for actionable tips to balance growth opportunities with risk management, but found advice that feels either overly simplistic or too technical. This post is tailored just for you: crypto enthusiasts and investors of all experience levels seeking clear, practical strategies to diversify effectively without overwhelming jargon. Here, we break down key diversification tactics—ranging from selecting varied coin types to balancing mining assets and speculative investments—designed to help you build a resilient portfolio. Our insights go beyond standard advice by integrating real-world market behaviors and emerging trends. By reading on, you'll gain a nuanced understanding to confidently tweak your portfolio for better returns and reduced vulnerabilities in an ever-evolving market.

- Master Cryptocurrency Portfolio Diversification Today

- Understanding Portfolio Diversification in Crypto

- Why Diversification Matters: Mitigating Risk in a Volatile Crypto Market

- Core Assets vs. Speculative Coins: Balancing Risk and Reward

- Including Different Crypto Asset Classes: Broadening Your Diversification Layers

- Crypto Mining Holdings in Your Portfolio: Diversify Beyond Tokens

- Risk Management Strategies for Crypto Portfolios

- Timing and Market Cycles: Adapting Diversification Strategies in Bull and Bear Markets

- Tools and Platforms for Managing Diversification

Understanding Portfolio Diversification in Crypto

Portfolio diversification in the cryptocurrency landscape refers to the strategic allocation of investments across a variety of digital assets to reduce risk and enhance potential returns. Unlike traditional assets such as stocks, bonds, or real estate, crypto investments operate in a uniquely volatile and rapidly evolving ecosystem. This means diversification in crypto isn't just about spreading capital across different coins, but also about balancing exposure to different asset classes within the blockchain space—such as stablecoins, utility tokens, NFTs, and mining-related investments.

The key difference between crypto diversification and traditional portfolio strategies lies in the market dynamics and technology-driven innovations that define cryptocurrencies. For instance:

- High Volatility and Correlations: Cryptocurrencies often experience dramatic price swings within short periods, and many altcoins tend to move in correlation with Bitcoin, requiring more nuanced diversification to truly mitigate risk.

- Diverse Asset Functionality: Different tokens serve various purposes—some act as currency, others provide governance rights, and some represent decentralized finance (DeFi) protocols—so diversifying based on functionality can shield your portfolio from sector-specific downturns.

- Emerging Market Risks: Regulatory shifts, security vulnerabilities, and technological changes unique to blockchain can impact crypto differently than traditional assets, making dynamic diversification strategies essential.

By understanding these distinctions, investors can craft a crypto portfolio that not only spreads risk but also capitalizes on the broad innovation and growth opportunities available within the digital asset world. This approach helps hedge against the volatility inherent in the market while positioning the portfolio to participate in multiple avenues of crypto-driven returns.

Image courtesy of Photo By: Kaboompics.com

Why Diversification Matters: Mitigating Risk in a Volatile Crypto Market

In the fast-paced world of cryptocurrency, diversification is not just a strategy—it's a necessity to navigate the wild swings and inherent uncertainties. Crypto markets are notoriously volatile, with prices influenced by everything from market sentiment and technological updates to regulatory developments and global economic shifts. By diversifying your portfolio across a range of coins and crypto asset types, you significantly reduce the impact of any single asset’s downturn on your overall holdings.

Key Risks Diversification Helps Mitigate

-

Volatility and Market Swings: Cryptocurrencies can surge or crash dramatically within hours. A well-diversified portfolio balances high-growth altcoins with more stable tokens, such as stablecoins pegged to fiat, providing a smoother overall return profile.

-

Regulatory Impact: Different cryptos face varying degrees of regulatory scrutiny around the world. Some assets may be more vulnerable to bans, restrictions, or compliance requirements. Spreading investments across multiple jurisdictions and asset classes helps insulate your portfolio from localized regulatory shocks.

-

Project-Specific Risks: Individual blockchain projects can encounter issues like development delays, security breaches, or governance conflicts. Diversifying among projects with varied purposes and strong fundamentals limits exposure to any single failure.

By embedding diversification as a core principle, crypto investors can build resilient portfolios that weather downturns and seize opportunities across the entire blockchain ecosystem. This risk mitigation isn't about avoiding volatility completely—it’s about managing it intelligently to protect capital and promote long-term growth in an unpredictable market.

Image courtesy of RDNE Stock project

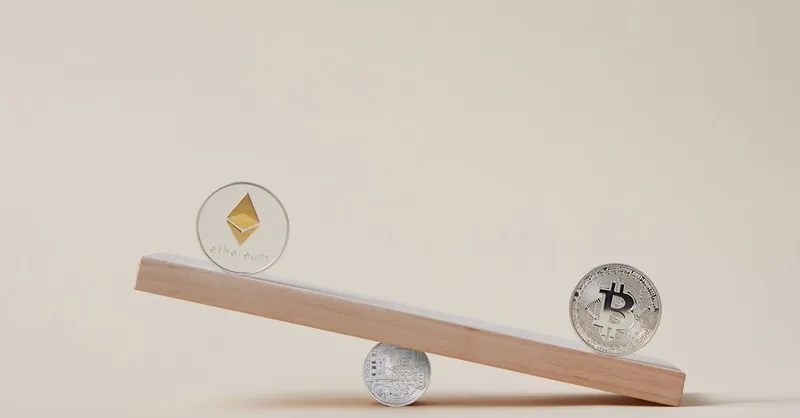

Core Assets vs. Speculative Coins: Balancing Risk and Reward

When building a crypto portfolio, striking the right balance between core assets like Bitcoin and Ethereum and more speculative altcoins is essential to optimizing both risk management and growth potential. Core assets are widely recognized cryptocurrencies with established networks, strong liquidity, and relatively lower volatility compared to smaller altcoins. They form the backbone of your portfolio, providing stability and a safeguard against extreme market swings.

Why Core Assets Matter

- Market Leadership and Stability: Bitcoin and Ethereum dominate the market due to robust adoption, network security, and developer activity. Holding these core coins reduces systemic risk and anchors your portfolio to the most resilient players.

- Liquidity and Accessibility: High liquidity ensures that you can enter or exit positions easily without significant price impact, an important factor during volatile market conditions.

- Long-Term Growth: Historically, core assets have demonstrated strong resilience and appreciation over time, making them ideal for wealth preservation and steady portfolio appreciation.

The Role of Speculative Coins

Speculative altcoins, often smaller projects or emerging tokens, present higher risk but also the opportunity for outsized returns. Diversifying a portion of your portfolio into these coins can capture growth from innovation and niche use cases within DeFi, NFTs, or new blockchain protocols. However, these investments require thorough research and continuous monitoring due to their heightened volatility and project-specific risks.

Striking the Right Balance

- Core Assets: Allocate approximately 60-80% of your portfolio to established cryptocurrencies like Bitcoin and Ethereum for foundational security.

- Speculative Coins: Reserve 20-40% for altcoins with strong potential but higher risk profiles to fuel potential upside.

- Regular Rebalancing: Continuously evaluate your portfolio to manage exposure as market dynamics shift, locking in profits from speculative coins and replenishing core holdings when appropriate.

By thoughtfully blending core assets and speculative coins, you create a dynamic portfolio that harnesses the stability of crypto veterans while staying agile enough to seize new growth frontiers. This balanced approach is crucial for navigating the unpredictable yet lucrative terrain of cryptocurrency investing.

Image courtesy of DS stories

Including Different Crypto Asset Classes: Broadening Your Diversification Layers

To build a truly resilient and growth-oriented cryptocurrency portfolio, it’s essential to go beyond just coins and tokens and incorporate diverse crypto asset classes. Each asset class interacts with market dynamics differently, offering unique risk profiles and potential returns. By allocating capital across various types—such as coins from different blockchains, stablecoins, utility tokens, and even emerging assets like NFTs—you create multiple layers of diversification that can help smooth volatility and capture opportunities across the evolving crypto ecosystem.

Key Crypto Asset Classes to Include

-

Native Coins: These are the primary cryptocurrencies native to their blockchain ecosystems, like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), or Solana (SOL). They usually provide foundational exposure to blockchain adoption, network security, and transaction activity.

-

Utility Tokens: These tokens grant access to decentralized applications (dApps) or blockchain services—for example, tokens used within DeFi platforms, gaming, or data networks. Utility tokens often reflect user engagement and platform growth, offering growth potential tied to ecosystem development.

-

Stablecoins: Digital assets pegged to fiat currencies (e.g., USDT, USDC, DAI) act as a critical portfolio stabilizer. They provide liquidity and reduce exposure to market volatility, allowing you to hedge during downturns or capitalize on trading opportunities.

-

Non-Fungible Tokens (NFTs): Though less liquid and more speculative, NFTs represent ownership or rights over digital art, collectibles, or even real-world assets. Adding NFTs can diversify your portfolio into the booming digital collectibles and metaverse sector, which operates differently from traditional tokens.

-

Cross-Chain and Layer 2 Tokens: Blockchains like Polkadot, Avalanche, and Layer 2 solutions on Ethereum (such as Polygon) offer tokens that benefit from interoperability and scalability improvements. Investing here exposes your portfolio to innovation in blockchain infrastructure and cross-chain compatibility.

Why Diversification Across Asset Classes Matters

- Reduced Correlation Risk: Different asset classes tend to react differently to market events. For instance, stablecoins remain steady during high volatility periods, while NFTs might gain interest from cultural trends rather than pure market sentiment.

- Capture Multiple Growth Avenues: By including a blend of coins, tokens, and digital assets, you participate in various market niches—DeFi, gaming, infrastructure, and collectibles—maximizing your exposure to new innovations.

- Liquidity and Flexibility: Stablecoins and popular utility tokens add liquid options to your portfolio, enabling faster trading or deployment of capital without waiting for coin price recoveries.

Incorporating these diverse crypto asset classes as layers within your portfolio not only diversifies risk but also positions you strategically to benefit from the full spectrum of the crypto market’s growth potential. This multi-dimensional approach is especially important in a rapidly shifting landscape where emerging asset types and blockchain advancements can redefine value creation overnight.

Image courtesy of Jievani

Crypto Mining Holdings in Your Portfolio: Diversify Beyond Tokens

When thinking about diversification in the crypto space, investing solely in tokens and coins limits your exposure to only one facet of the blockchain ecosystem. Incorporating crypto mining-related holdings—either through direct ownership of mining equipment or investments in mining companies and mining pools—introduces an additional, valuable layer of portfolio diversification. Mining assets behave differently from token price movements because their value is often linked to operational efficiency, hardware demand, and network activity rather than purely speculative market sentiment.

Why Include Mining in Your Crypto Portfolio?

- Diversification of Revenue Streams: Mining generates revenue through block rewards and transaction fees, offering a form of income that isn’t strictly dependent on market price appreciation of tokens.

- Hedging Against Token Volatility: While token prices fluctuate daily, mining hardware and companies tend to have intrinsic value based on their technology, mining capacity, and operational scale. This can act as a buffer during market downturns.

- Exposure to Blockchain Infrastructure: Mining is foundational to the security and decentralization of many blockchain networks like Bitcoin and Ethereum (before ETH’s full transition away from proof-of-work). Holding mining-related assets means investing in the ecosystem’s core operational layer, not just the currency itself.

- Potential for Long-Term Growth: The demand for mining hardware and efficient energy solutions grows with blockchain adoption, making mining companies or hardware providers an intriguing bet on the future infrastructure of crypto.

How to Add Mining Exposure

- Direct Mining Equipment Ownership: Buying and operating ASICs or GPUs enables you to earn rewards directly, but this requires technical know-how, upfront costs, and considerations around electricity pricing.

- Investing in Mining Stocks or ETFs: Publicly traded mining companies or crypto-focused ETFs provide more accessible mining exposure without the operational complexities.

- Participating in Cloud Mining or Mining Pools: These platforms allow you to lease mining power or join collective mining efforts, sharing rewards based on your contribution.

By incorporating crypto mining holdings into your portfolio, you expand beyond digital tokens to tangible assets and infrastructure, creating a more balanced and resilient investment mix. This strategy aligns well with long-term crypto diversification goals, reducing reliance on market-driven token price swings while staying actively engaged with the broader blockchain innovation ecosystem.

Image courtesy of Jakub Zerdzicki

Risk Management Strategies for Crypto Portfolios

Effectively managing risk is critical to preserving capital and achieving consistent growth in your crypto portfolio. Beyond diversification, leveraging key risk management tools such as stop-loss orders, position sizing, and periodic portfolio rebalancing helps maintain a healthy asset mix and guards against market volatility and sudden downturns.

Stop-Loss Orders: Limiting Losses and Protecting Gains

A stop-loss order automatically sells an asset once it hits a predetermined price, preventing further losses in rapidly declining markets. Setting thoughtful stop-loss levels allows you to cap downside risk, especially in the volatile crypto environment where prices can swing dramatically within minutes. Incorporate stop-losses tailored to your investment horizon and risk tolerance—tight for speculative altcoins and more lenient for long-term core assets.

Position Sizing: Control Exposure to Individual Assets

Strategically sizing positions ensures no single investment dominates your portfolio or creates excessive exposure to risk. Many experts recommend allocating smaller percentages to high-volatility speculative coins and larger allocations to stable core assets like Bitcoin and Ethereum. By adjusting position sizes based on asset volatility, project fundamentals, and market conditions, you effectively manage risk while optimizing return potential.

Periodic Portfolio Rebalancing: Maintaining Your Desired Asset Allocation

Regular portfolio rebalancing involves adjusting your holdings back to your intended allocation to prevent over-concentration in winning assets or excessive losses in lagging ones. This disciplined process encourages selling high-performing assets to lock in profits and buying undervalued coins to capitalize on recovery potential. Rebalancing intervals can vary—from monthly to quarterly—depending on your investment style and market dynamics.

Incorporating these risk management strategies alongside diversification enables you to build a crypto portfolio that is resilient, adaptive, and better positioned to withstand the uncertainties of the cryptocurrency market. Sound risk controls not only protect your capital but also foster disciplined decision-making crucial for long-term success.

Image courtesy of RDNE Stock project

Timing and Market Cycles: Adapting Diversification Strategies in Bull and Bear Markets

One of the most overlooked yet crucial aspects of crypto portfolio diversification is understanding how your strategy should shift in response to market cycles and overall sentiment. The cryptocurrency market is famously cyclical, swinging between bull markets characterized by rapid price increases and widespread optimism, and bear markets marked by downturns, volatility, and risk aversion. Adjusting your diversification tactics according to these phases can greatly improve your portfolio’s resilience and growth potential.

Diversification Tactics During Bull Markets

In a bull market, investors are generally more willing to take on risk, chasing high returns from emerging altcoins, DeFi projects, NFTs, and other speculative assets. Here, diversification emphasizes:

- Increasing exposure to speculative and high-growth areas: Allocating a larger share (30-40%) to altcoins, new blockchain protocols, or niche sectors like NFTs can capitalize on the positive momentum and innovation-driven price surges.

- Maintaining core asset holdings: While core assets like Bitcoin and Ethereum may have slower growth compared to smaller tokens, they provide a solid foundation to weather market shifts and secure long-term value.

- Active portfolio rebalancing: Profits in speculative coins can rapidly inflate portions of your allocation beyond your risk tolerance, so periodic rebalancing ensures you lock gains and avoid overexposure.

Diversification Approaches in Bear Markets

Bear markets demand a more conservative and preservation-focused diversification approach to shield your portfolio against steep declines:

- Shift towards stablecoins and defensive assets: Increasing allocation to stablecoins and well-established core cryptocurrencies reduces volatility and preserves capital during downturns.

- Reducing allocation to high-risk speculative tokens: Trimming back on volatile altcoins limits downside exposure when market sentiment turns negative and speculative assets usually suffer the most.

- Exploring mining and infrastructure assets: During bearish phases, mining holdings or blockchain infrastructure investments may offer income or relative stability due to their operational nature, acting as a hedge compared to price-only token investments.

Incorporating Market Sentiment into Diversification Decisions

Understanding broader market sentiment—whether driven by news, regulatory announcements, or macroeconomic factors—can help refine your diversification strategy further:

- In optimistic environments with rising participation and liquidity, increasing exposure to innovation-driven projects and layering emerging asset classes can boost returns.

- Conversely, when sentiment turns fearful or uncertain, prioritizing liquidity and risk reduction by bolstering stablecoins and trusted core assets protects your portfolio from heavy losses.

By dynamically adjusting your diversification based on timing and market cycles, you actively manage risk and seize opportunities tailored to the crypto market’s ebb and flow. This informed flexibility is key to maximizing long-term returns and minimizing vulnerabilities in a notoriously volatile and sentiment-driven asset class.

Image courtesy of Alesia Kozik

Tools and Platforms for Managing Diversification

Effectively managing a diversified crypto portfolio requires more than just strategic allocation—it demands the right tools and platforms that provide real-time insights, comprehensive analytics, and automation capabilities. Leveraging these resources not only simplifies portfolio tracking but also empowers you to make data-driven adjustments tailored to your diversification goals. Whether you’re juggling multiple coins, mining investments, or NFTs, having a centralized dashboard and smart analytics can enhance your decision-making in a volatile market.

Top Portfolio Trackers and Analytics Platforms

-

CoinStats

A versatile portfolio tracker supporting thousands of cryptocurrencies across multiple exchanges and wallets. CoinStats offers real-time sync, detailed asset allocation breakdowns, and alerts to help you monitor your diversification status effortlessly. -

Delta

Known for its intuitive interface and robust analytics, Delta supports comprehensive portfolio tracking alongside news aggregation. It provides diversification metrics including sector exposure and risk analysis to keep your portfolio balanced. -

Zerion

Especially useful for DeFi investors, Zerion aggregates your holdings across Ethereum, Binance Smart Chain, and other networks. It allows easy monitoring of utility tokens, stablecoins, and liquidity positions, facilitating diversified strategy adjustments. -

CryptoCompare Portfolio

Features in-depth analytics and price tracking, combined with portfolio performance reports and diversified asset views. This tool helps you visualize your portfolio’s risk distribution across core assets, altcoins, and stablecoins.

Automated Tools to Enhance Diversification Management

- Rebalancing Bots: Platforms like Shrimpy or 3Commas enable automated portfolio rebalancing based on your targeted asset allocation. This keeps your investments aligned with diversification targets without constant manual intervention.

- Tax and Performance Software: Tools such as CoinTracker or Koinly provide tax reporting alongside portfolio health summaries, giving you a comprehensive view of how diversification impacts your overall returns and liabilities.

- Market Sentiment and Analytics Services: Integrate data from resources like Glassnode, Santiment, or Messari to gain insights on on-chain metrics and market trends. These analytics can guide allocation shifts to optimize diversification during volatile cycles.

Why Using the Right Tools Matters

- Real-Time Portfolio Visibility: Instant access to your holdings across multiple exchanges and wallets helps maintain balanced exposure and prevents unintended overconcentration in volatile assets.

- Data-Driven Decision Making: Advanced analytics highlight correlation risks, sector exposure, and token performance, aiding in fine-tuning your diversification approach.

- Efficiency and Automation: Automating routine tasks like rebalancing and alerts frees up time while reducing human error and emotional trading biases.

By integrating these powerful tools and platforms into your investment routine, you transform diversification from a cumbersome manual effort into a streamlined, dynamic strategy. This technological layer is essential for staying ahead in the fast-moving crypto markets and optimizing your portfolio’s risk-reward profile.

Image courtesy of Jakub Zerdzicki