Step-by-Step Bitcoin Investment Guide for All Levels

Category: Cryptocurrency

Unlocking Bitcoin Investment: A Clear Guide for Everyone

Whether you’re a crypto newcomer eager to take your first steps or a seasoned investor looking to sharpen your Bitcoin strategy, navigating the investment landscape can feel overwhelming. You want straightforward, actionable steps that cut through the hype and complexity. Perhaps you’ve searched for ways to securely buy, store, and grow your Bitcoin holdings, but felt bogged down by jargon or unsure about the right timing and tools. This guide arrives at just the right moment — designed specifically for cryptocurrency enthusiasts and investors across experience levels. Here, you’ll find a clear, easy-to-follow roadmap starting from understanding Bitcoin basics, through finding reliable platforms, making your first purchase, to managing risks and optimizing your holdings. Unlike generic articles, this post blends practical insights with approachable explanations, ensuring you can move confidently forward regardless of your prior knowledge. Dive in and discover how to build a smart Bitcoin investment foundation that aligns with your goals and appetite for risk, while staying up to date with market dynamics and security best practices.

- Unlocking Bitcoin Investment: A Clear Guide for Everyone

- Understanding Bitcoin: What It Is and Why It Matters

- Setting Investment Goals and Risk Assessment

- Choosing a Reliable Cryptocurrency Exchange

- Creating Your Bitcoin Wallet: Hot vs Cold Storage

- Step-by-Step Process to Buy Bitcoin Safely

- Securing Your Investment: Protecting Your Private Keys and Avoiding Scams

- Monitoring the Market and Managing Your Portfolio

- Tax Considerations and Legal Compliance for Bitcoin Investors

- Advanced Strategies: Dollar-Cost Averaging and Diversification

- Resources for Continued Learning and Staying Updated

Understanding Bitcoin: What It Is and Why It Matters

Before diving into the mechanics of investing, it’s crucial to grasp what Bitcoin truly is and why it has captured the attention of investors worldwide. Bitcoin is a decentralized digital currency, powered by blockchain technology, which allows secure peer-to-peer transactions without the need for intermediaries like banks or governments. This revolutionary concept offers transparency, immutability, and resistance to censorship—qualities that set Bitcoin apart from traditional fiat currencies.

The Technology Behind Bitcoin

At its core, Bitcoin operates on a blockchain, a distributed ledger that records all transactions across a network of computers (nodes). Each transaction is verified by miners who solve complex cryptographic puzzles, ensuring the security and integrity of the system. This decentralized nature makes Bitcoin highly resilient to fraud and manipulation, fostering trust in a trustless environment.

Why Bitcoin Investment Holds Potential

Investing in Bitcoin is not just about speculation; it’s about participating in a global financial shift. Bitcoin’s built-in scarcity — capped at 21 million coins — creates a unique deflationary asset, which many investors view as “digital gold.” Its growing acceptance across institutions and everyday users further enhances its liquidity and value potential. For those seeking portfolio diversification away from traditional assets like stocks and bonds, Bitcoin offers an alternative with its own risk-reward profile, shaped by emerging global adoption trends and innovative developments in the crypto space.

By understanding these foundational elements, you’re better equipped to evaluate Bitcoin’s role in your investment strategy and appreciate the importance of secure, informed decision-making as you start your crypto journey.

Image courtesy of Саша Алалыкин

Setting Investment Goals and Risk Assessment

Before you make your first Bitcoin purchase, it's essential to set clear investment goals and evaluate your risk tolerance. Bitcoin's price can be highly volatile, which means understanding your financial objectives and how much risk you’re willing to take is a crucial foundation for a sustainable investing strategy.

Identifying Your Financial Goals

Start by defining what you want to achieve with your Bitcoin investment. Are you looking for:

- Long-term wealth accumulation? Holding Bitcoin as a store of value or “digital gold” over several years.

- Short-term gains? Taking advantage of price fluctuations for speculative trading.

- Portfolio diversification? Adding Bitcoin to reduce correlation with traditional asset classes like stocks or bonds.

- Hedging against inflation? Using Bitcoin to protect purchasing power during fiat currency depreciation.

Knowing your primary goal helps determine the right investment approach and influences your buying decisions, including the amount of capital you allocate to Bitcoin.

Assessing Your Risk Tolerance

Bitcoin’s market volatility means prices can swing dramatically in short periods. Assess your ability and willingness to withstand these fluctuations without emotional decision-making. Consider:

- Financial capacity: Only invest funds you can afford to lose without impacting your lifestyle or emergency savings.

- Emotional resilience: If sharp drops may lead to panic selling or regret, a conservative approach or smaller position size may be wiser.

- Investment timeframe: Longer horizons often allow more room to ride out volatility, while short-term investors may need stricter risk controls.

By honestly gauging your risk tolerance, you can tailor your Bitcoin investment strategy to suit your comfort level and avoid costly mistakes driven by fear or greed.

Aligning Goals with Timeframe

Finally, set an investment timeframe that matches your objectives and risk appetite. Bitcoin investments might grow substantially over years, but short-term trading requires active monitoring and a higher risk threshold. A clear timeframe lets you plan whether to buy gradually (dollar-cost averaging) or make lump-sum investments while considering market conditions.

In summary, defining your investment goals, understanding your risk tolerance, and choosing an appropriate timeframe create the blueprint for a disciplined and confident Bitcoin investment journey. These preparatory steps not only enhance your potential for success but also help manage the emotional ups and downs common in the crypto market.

Image courtesy of RDNE Stock project

Choosing a Reliable Cryptocurrency Exchange

Selecting the right cryptocurrency exchange is a critical step in your Bitcoin investment journey, as it directly impacts the security, ease, and success of your transactions. With countless exchanges available, focusing on platforms that offer robust security measures, user-friendly interfaces, and transparent account verification processes ensures you can confidently buy, sell, and manage your Bitcoin holdings without unnecessary risk or frustration.

Key Criteria for Selecting Secure and User-Friendly Exchanges

When evaluating cryptocurrency exchanges, keep these essential factors in mind:

- Security Features

- Look for exchanges with strong security protocols such as two-factor authentication (2FA), cold storage for funds, encrypted data handling, and regular security audits.

-

Reputation matters—check for any history of hacks or breaches and how quickly and transparently the exchange addressed such issues.

-

Ease of Use

- A clean, intuitive interface helps both beginners and experienced investors navigate buying, selling, and monitoring assets efficiently.

-

Mobile app availability can offer flexibility in managing your investments on the go.

-

Liquidity and Trading Volume

- Higher liquidity means tighter spreads and faster order execution, which is crucial for price-sensitive Bitcoin purchases.

-

Popular exchanges typically have sufficient volume, ensuring smooth transactions at market prices.

-

Supported Payment Methods

- Ensure the exchange accepts payment options convenient for you, such as bank transfers, credit/debit cards, or even PayPal.

-

Check for reasonable fees associated with deposits, withdrawals, and trades.

-

Customer Support and Educational Resources

- Responsive customer service can help resolve issues quickly.

- Many top exchanges provide learning materials, tutorials, and market insights, which are valuable for ongoing education.

Understanding Account Verification Essentials

Most reliable exchanges enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, requiring users to verify their identity before fully accessing platform features. This process, while sometimes time-consuming, enhances platform security and regulatory compliance, ultimately protecting your funds.

Typical verification steps include:

- Submitting government-issued ID (passport, driver’s license)

- Providing proof of address (utility bills, bank statements)

- Sometimes selfie or video verification to confirm identity matches documents

Completing these verification steps fully unlocks deposit limits, withdrawal capabilities, and access to advanced trading features, making it a necessary part of a smooth Bitcoin investment experience.

By carefully choosing a cryptocurrency exchange that prioritizes security, usability, liquidity, and compliance, and completing the necessary account verifications, you build a strong foundation for safe and effective Bitcoin investing. This due diligence minimizes risks while maximizing your confidence and control in the dynamic crypto market.

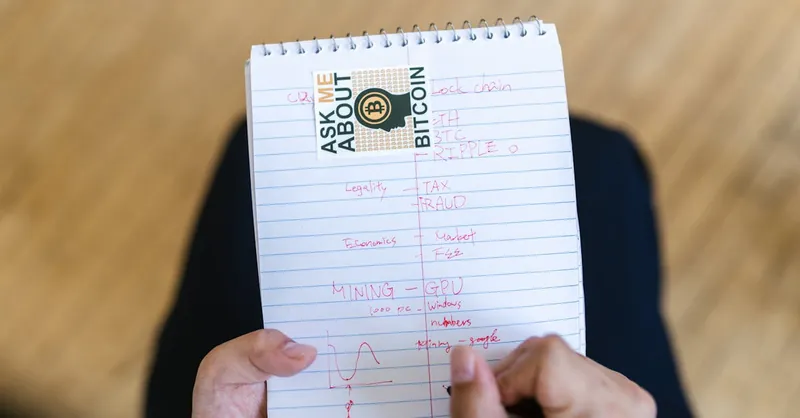

Image courtesy of Jakub Zerdzicki

Creating Your Bitcoin Wallet: Hot vs Cold Storage

Once you’ve selected a reliable exchange and completed your Bitcoin purchase, the next crucial step is securing your Bitcoin in a wallet. Understanding the difference between hot wallets and cold wallets is fundamental to safeguarding your investment against theft, hacking, or accidental loss.

What Are Bitcoin Wallets?

A Bitcoin wallet is a digital tool that stores your private keys, the cryptographic credentials granting access to your Bitcoin holdings on the blockchain. Unlike traditional banking, you don’t actually store bitcoins “inside” your wallet; instead, wallets allow you to send, receive, and manage your Bitcoin securely.

Wallets come in two main types:

- Hot Wallets: These are connected to the internet, making them convenient for frequent transactions and easy access.

- Cold Wallets: These are offline devices or storage methods that offer maximum security by isolating private keys from internet exposure.

Comparing Hot and Cold Storage

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Connectivity | Always online | Offline, disconnected from internet |

| Security Level | Moderate; susceptible to hacking | Very high; immune to online attacks |

| Ease of Use | User-friendly and quick transactions | Requires setup, less convenient |

| Best Use Case | Daily trading and small balances | Long-term storage of large amounts |

| Examples | Mobile wallets, desktop apps, web wallets | Hardware wallets, paper wallets |

Setting Up Your Bitcoin Wallet Step-by-Step

Hot Wallet Setup

- Choose a reputable wallet app

Popular options include Exodus, Electrum, or the wallet provided by your exchange for short-term use. - Download and install securely

Always get wallet apps from official sources or verified app stores. - Create a new wallet and back up your seed phrase

Upon setup, you’ll receive a 12- or 24-word recovery phrase. Write it down and store it offline—never share this phrase with anyone. - Enable security features

Use strong passwords and enable two-factor authentication if available to protect access.

Cold Wallet Setup

- Purchase a trusted hardware wallet

Brands like Ledger Nano X and Trezor are industry leaders. - Initialize the device offline following manufacturer instructions to generate your private keys securely.

- Backup your recovery seed phrase on physical paper or metal backup cards in a safe location to avoid loss due to damage or theft.

- Transfer Bitcoin from your exchange or hot wallet to the cold wallet address to secure your holdings offline.

Best Security Practices for Bitcoin Wallets

- Never share your private keys or seed phrases. These are the keys to your funds; exposure risks total loss.

- Use cold storage for significant or long-term holdings to mitigate hacking threats.

- Regularly update your wallet software to benefit from security patches.

- Consider multi-signature wallets for enhanced protection requiring multiple approvals for transactions.

- Be cautious when using hot wallets on public or unsecured networks to prevent interception.

By carefully choosing and setting up the right Bitcoin wallet type aligned with your usage patterns and security needs, you lay the foundation for a protected Bitcoin investment portfolio. Prioritizing wallet security ensures peace of mind as you navigate the evolving crypto landscape.

Image courtesy of Jonathan Borba

Step-by-Step Process to Buy Bitcoin Safely

Purchasing Bitcoin securely is the gateway to entering the exciting world of cryptocurrency investing. To ensure your Bitcoin investment journey starts on the right foot, it’s essential to follow a methodical process encompassing funding your account, placing orders accurately, and confirming transactions effectively. This approach minimizes risks, avoids costly mistakes, and helps you gain confidence in handling digital assets.

1. Funding Your Exchange Account

Before buying Bitcoin, you need to deposit funds into your chosen cryptocurrency exchange account. Depending on the platform, common funding methods include:

- Bank transfers (ACH or wire): Usually incur low fees but can take 1-3 business days to process.

- Credit or debit cards: Instant funding but often involve higher fees.

- Payment processors (e.g., PayPal, Skrill): Availability varies by exchange, with fees and limits to consider.

Verify the currency compatibility and minimum deposit requirements. For security, always initiate deposits from accounts in your name and double-check the exchange’s deposit addresses or payment instructions to avoid errors.

2. Placing Your Bitcoin Buy Order

Once your account funding clears, you’re ready to buy Bitcoin by placing an order on the exchange. There are two primary order types to understand:

- Market Orders: Instantly buy Bitcoin at the best available current price. This is ideal for beginners or those needing quick execution but may incur slightly higher costs due to price slippage.

- Limit Orders: Specify the price at which you want to buy Bitcoin. Your order executes only if the market reaches your set price. This approach offers control over purchase price but may take longer to fill or remain unfilled.

When placing an order, review the total purchase amount, associated fees, and estimated Bitcoin quantity you will receive. Remember that exchanges typically charge a trading fee (ranging from 0.1% to 0.5%), which affects your effective buying price.

3. Confirming and Securing Your Transaction

After submitting your order, the exchange will process it and, once executed, your Bitcoin balance will reflect in your account wallet. To ensure the transaction was successful, take these steps:

- Review transaction details: Check the quantity of Bitcoin received, transaction fees, and timestamp.

- Verify deposit to your personal wallet: For added security, transfer Bitcoin from the exchange to your private wallet (hot or cold storage) as discussed earlier. This reduces exposure to exchange security risks.

- Monitor blockchain confirmations: Bitcoin transactions require confirmations on the blockchain network to finalize. Exchanges often display the number of confirmations—generally, 3 to 6 confirmations are considered secure.

Best Practices for Safe Bitcoin Purchases

- Enable two-factor authentication (2FA) on your exchange account before funding or purchasing to add an extra security layer.

- Use reputable exchanges with transparent fee schedules and responsive support.

- Never share your account login credentials or private keys.

- Consider starting with small purchases to familiarize yourself with the process and reduce risk.

- Keep transaction records and screenshots for future reference or tax compliance.

By carefully funding your account through secure, verified channels, thoughtfully placing your Bitcoin buy orders, and diligently confirming and securing your transactions, you establish a safe and effective buying routine. This solid process not only protects your investment but also positions you to capitalize confidently on Bitcoin’s potential in the evolving crypto market.

Image courtesy of RDNE Stock project

Securing Your Investment: Protecting Your Private Keys and Avoiding Scams

When it comes to Bitcoin investing, security is paramount. Your private keys are the gateway to your Bitcoin assets, and losing control of them can result in irreversible loss. Therefore, safeguarding your private keys and being vigilant against scams like phishing attacks and fraud attempts are essential steps in protecting your investment and ensuring peace of mind.

Protecting Your Private Keys

Your private key is a unique alphanumeric code that proves ownership of your Bitcoin. Unlike passwords, private keys must never be shared or stored online unprotected. Here are critical tips to keep your private keys safe:

- Use cold storage for long-term holdings: Hardware wallets or offline paper wallets keep private keys disconnected from the internet, dramatically lowering hacking risks.

- Never store private keys or seed phrases in cloud services or email: These platforms can be hacked, exposing your sensitive data.

- Backup your seed phrases physically: Write them on paper or use durable metal backups and store them securely, such as in a safe or safety deposit box.

- Use strong passwords and two-factor authentication (2FA): Add these additional layers on any platform or wallet interface to prevent unauthorized access.

- Regularly update wallet software: Keeping your wallets up-to-date ensures you benefit from the latest security patches and improvements.

Recognizing and Avoiding Scams

The crypto space is unfortunately rife with scams targeting both beginners and experienced investors. Being able to recognize common red flags and adopting cautious habits will protect your assets from phishing, fraud, and social engineering attacks.

- Beware of phishing emails and fake websites: Always verify URLs carefully, look for HTTPS encryption, and avoid clicking unsolicited links asking for login or private key information.

- Never share your private keys or seed phrases: No legitimate service or support representative will ever request this information.

- Be skeptical of “too good to be true” offers: Investment schemes promising guaranteed high returns or insider tips often are scams.

- Verify project legitimacy: Before investing in any crypto service, wallet, or ICO, research reviews, regulatory status, and community feedback extensively.

- Use official applications and exchanges: Download wallets or apps only from verified sources to avoid counterfeit software designed to steal credentials.

By following these security best practices, you significantly reduce the risk of falling victim to theft or fraud and keep control firmly in your hands. Protecting your private keys and staying alert to scams are foundational habits that every Bitcoin investor needs to cultivate for long-term success in the cryptocurrency market.

Image courtesy of George Becker

Monitoring the Market and Managing Your Portfolio

Once you’ve secured your Bitcoin investment, the journey is far from over. Consistent market monitoring and active portfolio management are essential practices to maximize your returns and mitigate risks in the volatile cryptocurrency landscape. Leveraging the right tools and strategies helps you stay informed about Bitcoin price movements, set timely alerts, and maintain a balanced portfolio tailored to your investment goals.

Using Tools to Track Bitcoin Prices and Market Trends

Staying updated on Bitcoin’s market behavior is crucial because of its notorious price volatility and the fast-evolving crypto ecosystem. Utilize reliable tracking tools and platforms that provide real-time price data, historical charts, and market sentiment indicators. Popular options include:

- CoinMarketCap and CoinGecko: Comprehensive aggregators offering price tracking for Bitcoin and altcoins alongside market cap and volume statistics.

- TradingView: Advanced charting software with customizable technical indicators and alerts for Bitcoin price thresholds.

- Crypto news aggregators: Websites and apps like CryptoPanic or CoinDesk provide timely news feeds that impact market direction.

Regularly reviewing these resources allows you to make informed decisions rather than reacting impulsively to market hype or fear.

Setting Alerts for Price Movements

Automated alerts are powerful for maintaining awareness without constant manual monitoring. Set up custom notifications on your preferred exchange or trading platform to trigger when Bitcoin hits specific price levels or experiences unusual volume spikes. Alerts help you identify:

- Entry points for buying more Bitcoin or altcoins.

- Exit points to secure profits or limit losses.

- Significant market shifts that may warrant portfolio rebalancing.

By defining price thresholds aligned with your investment strategy, alerts act as your personalized market watchdog, ensuring you don’t miss critical opportunities or risks.

Rebalancing Your Portfolio: Diversifying with Altcoins and Fiat

Bitcoin is often the cornerstone of a crypto portfolio, but diversification can enhance risk management and growth potential. Periodically reassess your asset allocation between Bitcoin, altcoins, and fiat currency based on market trends and your risk tolerance.

Key rebalancing considerations include:

- Assess your current portfolio balance against your target allocation. For example, an investor may aim for 70% Bitcoin, 20% altcoins, and 10% fiat.

- Take profits or cut losses by selling assets that have deviated significantly from targets due to price appreciation or depreciation.

- Redistribute funds to underweighted assets to maintain a balanced risk-reward profile.

Using portfolio management apps like Blockfolio, Delta, or CoinStats can simplify tracking your holdings and trigger rebalancing alerts. Remember, regular rebalancing ensures your portfolio remains aligned with your goals and market outlook, helping you avoid overexposure to volatile assets while participating in upside potential.

Summary of Best Practices for Market Monitoring and Portfolio Management

- Leverage trusted market tracking tools for accurate Bitcoin price data and trends.

- Set tailored alerts to stay alert to key price levels and market movements without constant monitoring.

- Regularly rebalance your portfolio to maintain your preferred asset allocation and risk profile.

- Stay informed with reliable crypto news sources to anticipate influential events affecting Bitcoin and altcoins.

- Avoid emotional trading decisions by basing actions on predefined strategies and alerts.

By integrating these monitoring and management routines into your Bitcoin investment strategy, you enhance your ability to respond smartly to market fluctuations, protect gains, and optimize portfolio growth in the dynamic world of cryptocurrency.

Image courtesy of Alesia Kozik

Tax Considerations and Legal Compliance for Bitcoin Investors

Understanding the tax implications and legal requirements related to Bitcoin transactions is crucial to maintaining compliance and avoiding costly penalties. Bitcoin, classified variably as property, currency, or an asset depending on your country, often triggers tax obligations when you buy, sell, trade, or use it. Staying informed about your local regulations ensures that your Bitcoin investment remains both profitable and lawful.

Reporting Bitcoin Transactions Accurately

Most tax authorities around the world require you to report gains or losses from Bitcoin transactions on your annual tax returns. This includes:

-

Capital Gains Tax:

If you sell Bitcoin for fiat currency or trade it for other cryptocurrencies or goods and services, the profit (difference between purchase price and sale price) is typically subject to capital gains tax. -

Income Tax:

Receiving Bitcoin as payment for services or mining rewards is commonly treated as taxable income based on the fair market value at the time of receipt. -

Record Keeping:

Maintaining detailed records of every Bitcoin transaction — including dates, amounts, exchange rates, counterparties, and wallet addresses — is essential for accurate tax reporting and audit defense.

Many countries now require disclosure of cryptocurrency holdings or have introduced specific guidance on how to calculate taxable income from crypto activities. Using crypto tax software or consulting tax professionals specializing in cryptocurrency can simplify compliance, minimize errors, and optimize tax outcomes.

Understanding Local Regulations and Staying Compliant

Regulations around Bitcoin vary widely by jurisdiction and can impact:

- Legal ownership and custody: Some regions impose strict rules on wallet providers and exchanges concerning KYC and AML compliance.

- Reporting thresholds: Authorities may require reporting only if transactions exceed certain dollar amounts.

- Licensing requirements: Operating certain crypto services or businesses might call for licenses or registrations.

To stay compliant, always:

- Research your country’s specific cryptocurrency tax laws and regulations. Official government websites, tax agencies, and reputable legal resources are good starting points.

- Declare your Bitcoin holdings and transactions honestly. Avoiding or underreporting taxes can lead to penalties, interest, or legal consequences.

- Stay updated with evolving laws. The crypto regulatory landscape is rapidly changing, and staying informed helps you adapt investment and reporting strategies proactively.

By integrating tax planning and legal compliance into your Bitcoin investment routine, you protect yourself from inadvertent violations and establish a transparent, sustainable approach to growing your digital asset portfolio. This awareness not only safeguards your finances but also contributes to the broader legitimacy and adoption of cryptocurrency markets.

Image courtesy of RDNE Stock project

Advanced Strategies: Dollar-Cost Averaging and Diversification

Navigating Bitcoin’s notorious price volatility can be challenging, especially for investors aiming to optimize returns while mitigating risk. Two advanced investment strategies—Dollar-Cost Averaging (DCA) and diversification across cryptocurrency assets—provide effective tools to build resilience and capitalize on market opportunities systematically.

Harnessing Dollar-Cost Averaging (DCA) for Volatility Management

Dollar-Cost Averaging is an investment technique where you consistently purchase fixed amounts of Bitcoin at regular intervals, regardless of its price fluctuations. This strategy smooths out the impact of market volatility by avoiding the pitfalls of attempting to time the market perfectly.

Benefits of Dollar-Cost Averaging:

- Mitigates emotional decision-making: By automating purchases, DCA helps investors avoid panic buying during price spikes or panic selling during dips.

- Reduces risk of market timing errors: Instead of investing a lump sum at once, DCA spreads the investment over time, minimizing exposure to sudden downturns.

- Builds disciplined investing habits: Regular contributions, such as weekly or monthly Bitcoin buys, encourage steady accumulation and long-term perspective.

Implementing DCA is straightforward—choose a reliable platform that supports recurring purchases, set your investment amount and frequency, and let the process run in the background, steadily growing your Bitcoin holdings while smoothing out volatility drawbacks.

Leveraging Diversification to Optimize Returns and Manage Risks

While Bitcoin often remains the centerpiece of a cryptocurrency portfolio, diversifying across altcoins and other digital assets is a proven strategy to spread risk and seek growth beyond Bitcoin alone. Diversification helps balance the unique volatility patterns and potential upside of different cryptocurrencies.

Key diversification considerations include:

- Selecting complementary altcoins: Invest in projects with solid fundamentals, use cases, and strong development teams, such as Ethereum (ETH), Binance Coin (BNB), or emerging layer-2 scaling solutions.

- Balancing portfolio allocation: Determine your optimal mix—e.g., a 70% Bitcoin and 30% altcoins split—aligned with your risk tolerance and investment timeframe.

- Including stablecoins for liquidity: Holding stablecoins like USDT or USDC provides flexibility to capitalize on market dips or new opportunities without needing to liquidate other assets.

Combining diversification with DCA offers a powerful approach: systematically investing not only in Bitcoin but also in a curated selection of cryptocurrencies can reduce overall portfolio volatility and increase chances for compounded growth.

By embracing consistent investment with Dollar-Cost Averaging and strategic diversification across cryptocurrencies, you can better manage Bitcoin’s inherent risks while positioning your portfolio for optimized long-term returns in the dynamic crypto market.

Image courtesy of beyzahzah

Resources for Continued Learning and Staying Updated

As the cryptocurrency landscape evolves rapidly, staying informed and educated is vital for making sound Bitcoin investment decisions and adapting to market shifts. Building your knowledge base through trusted resources empowers you to understand emerging trends, recognize risks, and seize opportunities confidently. Below is a curated list of recommended books, websites, forums, and news sources that will deepen your crypto expertise and keep you updated on Bitcoin and the broader blockchain ecosystem.

Must-Read Books on Bitcoin and Cryptocurrency

- “The Bitcoin Standard” by Saifedean Ammous

A foundational read explaining Bitcoin’s economic principles, history, and potential role as sound money in the modern financial system. - “Mastering Bitcoin” by Andreas M. Antonopoulos

A technical deep dive suited for investors and developers seeking a comprehensive understanding of Bitcoin’s architecture and security. - “Cryptoassets” by Chris Burniske and Jack Tatar

Offers insights into valuation, portfolio management, and investment strategies across Bitcoin and alternative cryptocurrencies. - “The Basics of Bitcoins and Blockchains” by Antony Lewis

An accessible guide that breaks down complex crypto concepts for beginners and intermediate learners.

Essential Websites and News Portals

- CoinDesk (coindesk.com)

Industry-leading source for Bitcoin news, market data, analysis, and expert opinions. - CoinTelegraph (cointelegraph.com)

Covers breaking news, market trends, and comprehensive guides for various experience levels. - Bitcoin.org (bitcoin.org)

An authoritative resource for Bitcoin fundamentals, wallets, and developer tools. - Glassnode (glassnode.com)

Provides on-chain analytics and insights to track Bitcoin supply, network activity, and investor behavior.

Active Forums and Community Hubs

- BitcoinTalk Forum (bitcointalk.org)

The oldest and most extensive Bitcoin community forum for discussions, announcements, and user support. - Reddit – r/Bitcoin (reddit.com/r/Bitcoin)

A vibrant subreddit where investors share news, analysis, and questions about Bitcoin developments. - Crypto Twitter

Following influential Bitcoin developers, analysts, and thought leaders on Twitter is a great way to access real-time insights and debates.

Tools to Stay Ahead

- Crypto Alert Apps:

Apps like Blockfolio, Delta, or CoinStats allow you to track prices, portfolio performance, and receive news alerts customized to your interests. - Newsletter Subscriptions:

Consider subscribing to newsletters such as “The Pomp Letter” by Anthony Pompliano or “The Block” for curated analysis and updates delivered directly to your inbox.

By continuously exploring these trusted educational resources and engaging with active communities, you position yourself to make well-informed Bitcoin investment decisions. Staying current ensures you can adapt your strategy in response to technological innovations, regulatory changes, and market cycles—critical for long-term success in the dynamic world of cryptocurrency.

Image courtesy of Morthy Jameson