Future of Cryptocurrencies & Blockchain: Trends & Insights

Category: Cryptocurrency

Exploring the Future of Cryptocurrencies and Blockchain Technology

If you're a cryptocurrency enthusiast or investor—whether a seasoned pro or just starting out—you've likely wondered what the future holds for this rapidly evolving sector. Navigating the complex world of Bitcoin, altcoins, mining developments, and blockchain innovations can be overwhelming, especially when trying to separate transient hype from genuine technological progress. You're here because you want clear, insightful guidance on upcoming trends and their implications for your investments and understanding.

This post cuts through the noise by offering a comprehensive yet accessible look at how cryptocurrencies and blockchain technology are poised to evolve. You'll discover emerging use cases, technological improvements, regulatory landscapes, and market dynamics all while connecting these elements to practical insights for your crypto journey. Unlike other articles that recycle dated information, this guide synthesizes the latest expert analysis and market data to keep you ahead of the curve.

Stay with us as we unpack key advancements, challenges, and opportunities that will shape the cryptocurrency ecosystem—arming you with knowledge to make informed decisions regardless of your experience level. Whether you're here to optimize mining strategies, spot promising altcoins, or simply understand blockchain's broader potential, this post is tailored for you.

- Exploring the Future of Cryptocurrencies and Blockchain Technology

- Overview of Blockchain Technology Evolution

- The Role of Bitcoin and Leading Altcoins in Future Markets

- Emerging Blockchain Use Cases Beyond Currency

- Advancements in Mining Technology and Sustainability

- Regulatory Trends Impacting Crypto Adoption

- The Rise of Layer 2 Solutions and Scalability Enhancements

- Interoperability and Blockchain Integration

- Speculative Investment Strategies in a Changing Landscape

- The Impact of Institutional Adoption and Mainstream Acceptance

- Predictions and Expert Opinions on the Next Decade

Overview of Blockchain Technology Evolution

To truly grasp the future potential of cryptocurrencies and blockchain, it’s essential to understand how this revolutionary technology has evolved over time. Blockchain’s journey began with the release of Bitcoin in 2009, introducing the world to a decentralized, immutable ledger secured by proof-of-work consensus. This innovation addressed longstanding challenges in digital trust and fraud prevention, laying the technological foundations for a new digital economy.

Since that groundbreaking milestone, blockchain technology has undergone significant milestones that expanded its scope beyond simple peer-to-peer digital cash:

- Second-generation blockchains like Ethereum introduced smart contracts, enabling programmable automation and decentralized applications (dApps).

- Consensus mechanisms diversified, incorporating proof-of-stake, delegated proof-of-stake, and other energy-efficient algorithms, addressing scalability and sustainability concerns.

- The rise of layer-2 solutions and sharding offered ways to boost transaction throughput without sacrificing security.

- Growing interoperability protocols and cross-chain bridges began connecting isolated blockchain networks, fostering a more integrated ecosystem.

Today’s blockchain infrastructure is built on these cumulative innovations, combining decentralization, scalability, security, and programmability. This evolving technological foundation is critical for new use cases such as decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain transparency, and beyond. Understanding this evolution not only reflects the sector’s resilience but also sets the stage for anticipating emerging trends that will shape the future landscape of digital assets and blockchain-powered systems.

Image courtesy of Jonathan Borba

The Role of Bitcoin and Leading Altcoins in Future Markets

As the cryptocurrency market matures, Bitcoin remains the undeniable pioneer and store of value, often referred to as "digital gold." Its unparalleled network security, widespread adoption, and status as the first decentralized cryptocurrency position it as a cornerstone in future financial markets. Beyond its original design as a peer-to-peer payment system, Bitcoin’s evolving role now increasingly focuses on institutional investment, portfolio diversification, and integration into emerging financial instruments such as Bitcoin ETFs and digital asset custodianship. The anticipated adoption of technologies like the Lightning Network further enhances Bitcoin’s scalability and usability, making it more practical for everyday transactions while maintaining its core value proposition.

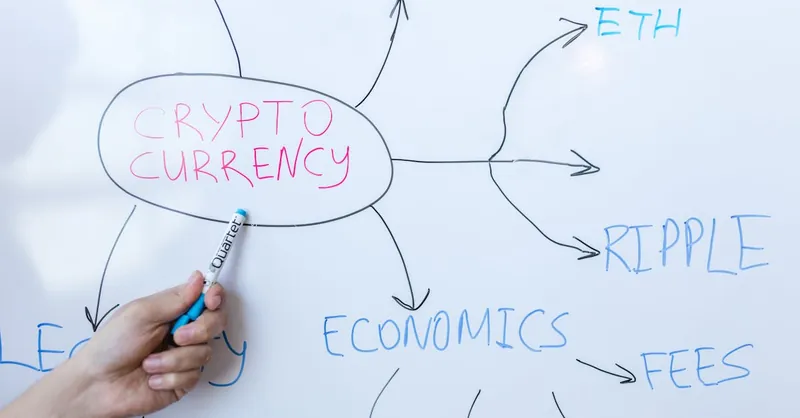

Meanwhile, leading altcoins such as Ethereum, Binance Coin (BNB), Solana, and Cardano are actively reshaping the crypto economy through their innovative functionalities and ecosystems. Ethereum’s transition to a proof-of-stake consensus mechanism with Ethereum 2.0 exemplifies how altcoins are addressing major challenges like energy consumption and network scalability. These platforms foster growth in decentralized finance (DeFi), non-fungible tokens (NFTs), and programmable money, driving new use cases that extend blockchain’s reach into real-world applications. As altcoins mature, their specialized features—ranging from fast transaction speeds to interoperability—are creating competitive advantages that influence market dynamics and investment strategies. Understanding how Bitcoin and these top altcoins adapt and influence future markets is essential for investors aiming to navigate the evolving crypto landscape with confidence.

Image courtesy of Jonathan Borba

Emerging Blockchain Use Cases Beyond Currency

While cryptocurrencies like Bitcoin and Ethereum have captured much of the spotlight, blockchain technology’s potential extends far beyond serving as digital money. As its underlying capabilities mature, blockchain is finding transformative applications across diverse industries, showcasing its versatility and expanding role in the global economy. Here are some of the most compelling emerging blockchain use cases reshaping sectors well beyond currency:

-

Supply Chain Transparency and Traceability

Blockchain’s immutable ledger provides an unparalleled method for tracking goods from origin to consumer. Companies in industries ranging from food and pharmaceuticals to luxury goods use blockchain to ensure product authenticity, reduce counterfeiting, and improve regulatory compliance. Real-time, tamper-proof data on sourcing, transportation, and handling enhances trust and efficiency in complex global supply chains. -

Healthcare Data Management and Security

Protecting sensitive medical records while enabling interoperability between healthcare providers is a persistent challenge. Blockchain-based systems offer secure, decentralized storage where patients control access to their data. This promotes privacy, improves data accuracy, and facilitates seamless sharing of medical histories, lab results, and prescriptions, thereby supporting personalized care and advanced research. -

Decentralized Finance (DeFi)

DeFi platforms leverage blockchain to recreate traditional financial services—lending, borrowing, trading, and asset management—without intermediaries like banks. This democratizes access to capital, increases transparency, and reduces costs. The DeFi ecosystem continues to innovate with yield farming, decentralized exchanges (DEXs), and collateralized loans, driving financial inclusion and new investment frontiers. -

Non-Fungible Tokens (NFTs) and Digital Ownership

NFTs have revolutionized how creators monetize digital art, music, gaming assets, and intellectual property by establishing provable ownership and provenance on-chain. This has created entirely new markets for digital collectibles, virtual real estate, and tokenized real-world assets, fueling a booming economy based on digital scarcity and community engagement. -

Governance and Identity Verification

Blockchain enables decentralized autonomous organizations (DAOs) that facilitate transparent, community-driven governance models. Additionally, blockchain-based identity solutions empower users with sovereign control over their personal information, streamlining KYC processes and reducing fraud in finance, voting, and access management.

These exciting developments reveal that blockchain is evolving into a multi-industry infrastructure that enhances transparency, security, and decentralization across numerous real-world applications. As projects continue to innovate and scale, the integration of blockchain with IoT, AI, and cloud computing is poised to unlock even more transformative capabilities, solidifying its position as a foundational technology for the digital age.

Image courtesy of fauxels

Advancements in Mining Technology and Sustainability

As cryptocurrencies continue to gain mainstream traction, the evolution of mining technology stands at the forefront of securing decentralized networks while addressing growing environmental concerns. Traditional proof-of-work (PoW) mining, especially for Bitcoin, has long been criticized for its significant energy consumption. However, recent innovations in mining hardware and energy-efficient solutions are transforming the mining landscape—balancing security, profitability, and sustainability.

Innovations in Mining Hardware

Next-generation mining rigs are becoming more powerful and energy-efficient thanks to advances in semiconductor technology and optimized chip architectures. Application-specific integrated circuits (ASICs) now achieve higher hash rates at lower wattage, substantially improving mining effectiveness. Additionally:

- Adaptive cooling technologies reduce thermal output, extending hardware lifespan and minimizing electrical waste.

- Modular and scalable mining setups allow operators to fine-tune performance and energy usage dynamically, aligning with fluctuating market conditions.

- AI-driven mining management systems optimize real-time resource allocation, maximizing returns while limiting unnecessary power consumption.

Energy Consumption Solutions and Eco-Friendly Mining

The push for greener mining practices is reshaping the industry’s environmental impact. Many mining operations are integrating renewable energy sources such as solar, wind, and hydroelectric power to reduce carbon footprints. Some innovative strategies include:

- Leveraging excess or stranded energy, like natural gas flaring capture or geothermal energy, to power mining farms without competing with local grids.

- Exploring hybrid consensus models, combining proof-of-work with proof-of-stake (PoS) or other low-energy algorithms, which maintain decentralization while drastically cutting energy demands.

- Developing carbon offset programs and transparent ESG reporting standards to attract eco-conscious investors and regulators.

Impact on Ecosystem Decentralization

These technological and sustainability advances have direct implications for the decentralization of blockchain ecosystems. Historically, energy-intensive mining favored large-scale operators with access to cheap electricity, risking centralization through mining pool consolidation. However, the rise of efficient and adaptable mining equipment democratizes participation by:

- Enabling smaller miners to remain competitive with reduced operational costs.

- Opening opportunities for localized, renewable-powered mining hubs that support geographic diversity.

- Supporting multi-chain mining approaches, allowing miners to switch to different networks that maximize profitability and sustainability.

In combination, these trends signal a more equitable and environmentally responsible future for cryptocurrency mining, essential to preserving blockchain’s core principles of trustless decentralization and network security. Staying informed on mining innovations and sustainability will be crucial for investors and enthusiasts looking to engage with the crypto ecosystem's evolving infrastructure.

Image courtesy of Kindel Media

Regulatory Trends Impacting Crypto Adoption

As the cryptocurrency market continues to expand globally, regulatory frameworks are becoming a pivotal factor influencing adoption, investor confidence, and the overall trajectory of the industry. Governments and regulatory bodies worldwide are grappling with how to balance innovation with the need to protect consumers, prevent illicit activities, and ensure financial stability. Understanding these evolving regulatory trends is essential for investors, developers, and businesses operating within the crypto ecosystem.

Current Regulatory Landscape

-

Increasing Compliance Requirements

Many countries are introducing or updating regulations to impose stricter know-your-customer (KYC) and anti-money laundering (AML) rules on cryptocurrency exchanges and service providers. This shift aims to enhance transparency but also raises challenges for privacy-centric projects. -

Taxation Policies

Tax authorities globally are defining clearer guidelines on how crypto transactions, capital gains, and mining income should be reported and taxed. This increased clarity helps legitimize crypto assets but also introduces greater reporting burdens for individual and institutional investors. -

Security and Investor Protections

Regulatory agencies such as the U.S. SEC and European ESMA are actively scrutinizing initial coin offerings (ICOs), stablecoins, and crypto asset classifications to safeguard investors from scams and market manipulation. Some jurisdictions have banned or restricted certain crypto products, impacting market liquidity and token utility.

Anticipated Regulatory Developments

-

Global Regulatory Coordination

We can expect greater cooperation between nations through organizations like the Financial Action Task Force (FATF) to develop standardized crypto regulations. Uniform guidelines will promote safer cross-border transactions and reduce regulatory arbitrage. -

Regulation of Decentralized Finance (DeFi)

As DeFi platforms gain traction, regulators are exploring how to oversee these often permissionless and anonymous protocols. Balancing innovation with accountability will shape the future accessibility and risk profile of DeFi services. -

Central Bank Digital Currencies (CBDCs) Influence

The rise of CBDCs presents regulatory complexities and opportunities, potentially integrating with or competing against cryptocurrencies. Regulatory frameworks will evolve to address interoperability, privacy concerns, and systemic risks linked to digital fiat.

Effects on Crypto Markets and Investor Protection

- Heightened regulation tends to increase market legitimacy, attracting institutional investors seeking regulated environments that mitigate fraud and operational risks.

- Conversely, heavy-handed or unclear policies can stifle innovation, reduce accessibility, and drive activity towards less regulated or underground markets.

- Enhanced compliance promotes investor protection by fostering transparency, reducing scams, and ensuring better dispute resolution mechanisms, which is crucial for mass adoption.

In summary, staying informed about regulatory trends and proactively adapting to evolving compliance standards is vital for anyone engaged in the cryptocurrency space. Strategic navigation of this complex and dynamic legal terrain will be a key determinant of long-term success for crypto projects and investors alike.

Image courtesy of RDNE Stock project

The Rise of Layer 2 Solutions and Scalability Enhancements

As blockchain adoption accelerates, scalability and transaction costs remain key hurdles for mass acceptance of cryptocurrencies and decentralized applications. Layer 1 blockchains like Bitcoin and Ethereum face inherent limitations in transaction throughput and high fees during network congestion, which hinder user experience and commercial viability. To overcome these challenges, the development of Layer 2 solutions and other scalability enhancements has become a critical focus area, promising faster, cheaper, and more efficient blockchain interactions without compromising security or decentralization.

What Are Layer 2 Solutions?

Layer 2 protocols operate on top of existing base blockchains (Layer 1) to process transactions off-chain or through optimized mechanisms, alleviating congestion and enabling near-instant settlement. By handling bulk operations off the main chain and only periodically settling final states back to Layer 1, these solutions drastically reduce fees and increase throughput. Some of the most prominent Layer 2 technologies include:

- State Channels – Enable participants to transact multiple times off-chain, recording just the opening and closing balances on-chain, greatly reducing the load.

- Rollups (Optimistic and ZK Rollups) – Batch hundreds or thousands of transactions off-chain and submit a compressed proof or summary to Layer 1, boosting scalability while preserving security guarantees.

- Plasma Chains – Child blockchains anchored to the main chain that process transactions independently but rely on Layer 1 for finality and dispute resolution.

- Sidechains – Separate blockchains interoperable with the main network, facilitating faster and cheaper asset transfers and operations.

Importance for Mass Adoption

Without effective scalability measures, blockchain networks risk becoming prohibitively expensive and slow, deterring everyday users and enterprise applications. Layer 2 solutions directly address this bottleneck by:

- Reducing transaction costs, making microtransactions and frequent interactions economically viable.

- Increasing transaction speeds, supporting real-time applications like gaming, payments, and decentralized exchanges.

- Enhancing network capacity, enabling blockchains to handle thousands to millions of transactions per second in aggregate.

- Preserving security and decentralization by anchoring operations firmly to Layer 1 consensus protocols.

Future Outlook

The continued innovation and deployment of Layer 2 technologies will play a pivotal role in achieving scalable and sustainable blockchain ecosystems. Projects integrating Layer 2 with emerging solutions like sharding and cross-chain interoperability are setting the stage for a more robust, user-friendly crypto environment. For investors and enthusiasts, understanding the nuances and adoption progress of these scalability enhancements is crucial—Layer 2 solutions not only elevate existing blockchain capabilities but also unlock new opportunities across DeFi, NFTs, and decentralized applications, accelerating blockchain’s journey towards mainstream use.

Image courtesy of Jonathan Borba

Interoperability and Blockchain Integration

As the blockchain ecosystem grows increasingly diverse, interoperability has emerged as a crucial factor in unlocking the full potential of distributed ledgers. The ability for disparate blockchain networks to communicate, transfer assets, and share data seamlessly is vital for enhancing user experience, expanding use cases, and integrating blockchain with traditional financial systems. Without robust interoperability, blockchains risk becoming isolated "silos," limiting innovation and adoption.

Efforts Driving Seamless Cross-Chain Communication

Multiple protocols and projects are pioneering solutions to enable cross-chain interoperability, facilitating secure and trust-minimized interactions between distinct blockchains. Key approaches include:

-

Cross-Chain Bridges

Bridges connect different blockchain networks by locking assets on one chain and minting equivalent tokens on another, allowing users to move value or data across boundaries. Notable examples include the Binance Bridge and Polygon’s PoS Bridge, though security remains a critical challenge due to past bridge exploits. -

Interoperability Protocols and Standards

Initiatives like Polkadot’s Relay Chain, Cosmos’ Inter-Blockchain Communication (IBC) protocol, and Wanchain aim to create standardized frameworks where multiple blockchains coexist and interoperate cohesively, sharing consensus and state data without compromising decentralization. -

Atomic Swaps and Cross-Chain Smart Contracts

These mechanisms allow direct peer-to-peer trading or contract execution across chains without intermediaries, enhancing liquidity and enabling complex decentralized applications that span multiple networks.

Bridging Blockchain and Traditional Finance

Integrating blockchain with the legacy financial infrastructure is pivotal for broader adoption and regulatory compliance. Innovations focus on:

- APIs and Middleware Solutions that enable banks, payment processors, and custodians to interact with blockchain networks natively, facilitating real-time settlements, compliance checks, and asset tokenization.

- Developing centralized finance (CeFi) – decentralized finance (DeFi) bridges to allow seamless movement of assets and data between traditional finance platforms and decentralized protocols.

- Enhancing digital identity and KYC interoperability to streamline user onboarding across financial ecosystems.

Why Interoperability Matters for the Future

- Enhanced Liquidity and Market Efficiency: Cross-chain interoperability unlocks access to a broader pool of assets and users, reducing fragmentation and price inefficiencies.

- Expanded Use Cases: It enables composite applications that leverage strengths of multiple blockchains—combining speed, security, programmability, and privacy features as needed.

- Reduced Barriers and User Friction: Users benefit from unified interfaces and smoother asset transfers, which are essential for mainstream adoption.

- Regulatory Compliance and Institutional Integration: Interoperable systems can more easily incorporate regulatory controls and reporting, bridging the gap between crypto and traditional finance sectors.

In conclusion, interoperability and blockchain integration efforts are foundational for a cohesive, scalable crypto ecosystem. As technologies mature, expect more seamless multi-chain experiences and closer alignment between blockchain networks and legacy financial systems—paving the way for mainstream cryptocurrency adoption and a truly connected digital economy.

Image courtesy of Marta Branco

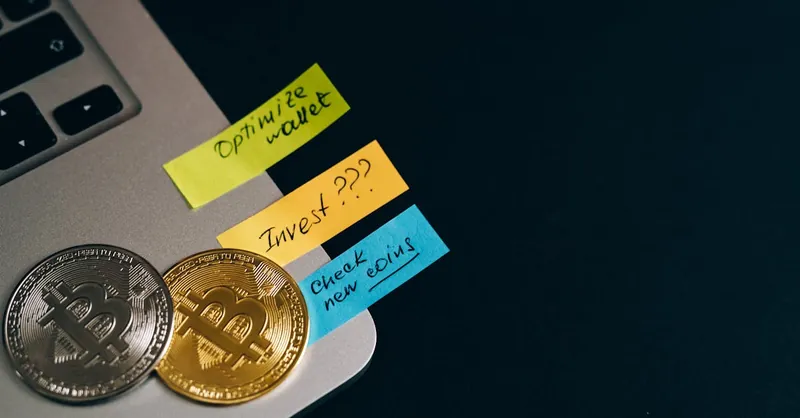

Speculative Investment Strategies in a Changing Landscape

Navigating the ever-evolving cryptocurrency market requires not only understanding technological advancements but also adopting speculative investment strategies that effectively balance opportunity and risk. The crypto space is inherently volatile, driven by rapid innovation cycles, regulatory shifts, and shifting market sentiment. To position yourself for future gains, it’s crucial to embrace adaptive strategies that consider this dynamic environment.

Navigating Volatility with Informed Risk Management

Cryptocurrency prices can swing dramatically within short periods, influenced by factors such as technological breakthroughs, regulatory news, macroeconomic events, and emerging trends. Effective risk management techniques help protect capital while maintaining exposure to promising assets:

- Diversification Across Asset Classes – Spread investments among established cryptocurrencies like Bitcoin and Ethereum, alongside promising altcoins and emerging tokens with strong fundamentals or innovative use cases.

- Position Sizing and Stop-Loss Orders – Allocate capital proportional to risk tolerance and set automatic exits to limit downside during sharp downturns.

- Regular Portfolio Rebalancing – Adjust holdings periodically to lock in profits and reinvest into undervalued opportunities, avoiding overexposure to overheated tokens.

- Utilizing Dollar-Cost Averaging (DCA) – Invest fixed amounts at regular intervals to smooth out volatility and reduce the risks of market timing mistakes.

Identifying Emerging Tokens and Opportunities

The future of cryptocurrencies will see continuous waves of new projects and tokens aiming to capture niche markets or innovative solutions. To capitalize on these emerging opportunities, speculative investors should:

- Conduct thorough fundamental analysis, evaluating a project’s technology, development team, roadmap, and community engagement.

- Track on-chain metrics such as transaction volume, active addresses, staking participation, and token supply dynamics to assess real usage and growth potential.

- Monitor market sentiment and trends through social media, news cycles, and developer activity to identify early momentum before mainstream attention.

- Stay abreast of sector innovations like Layer 2 scaling, DeFi protocols, NFTs, and interoperability solutions, where fresh tokens often surface with disruptive potential.

Balancing Speculation with Long-Term Vision

While speculation can generate significant gains, sustainable success involves recognizing which investments align with broader blockchain adoption trends and technological evolution. Integrating speculative plays with core holdings in reputable assets creates a balanced portfolio designed to withstand market turbulence and capitalize on blockchain’s long-term growth.

By coupling adaptive risk management with keen insight into emerging crypto innovations, investors can navigate this complex and volatile landscape more confidently—maximizing the potential for future profitable outcomes while mitigating downside risks inherent in speculative markets.

Image courtesy of Leeloo The First

The Impact of Institutional Adoption and Mainstream Acceptance

One of the most transformative forces shaping the future of cryptocurrencies and blockchain technology is the growing institutional adoption and mainstream acceptance by major corporations, financial institutions, and even governments. This trend not only increases the legitimacy of digital assets but also significantly influences market stability, liquidity, and long-term growth potential.

Institutional Players Driving Market Maturity

Large-scale investors such as hedge funds, asset managers, and publicly traded companies are increasingly incorporating cryptocurrencies like Bitcoin and Ethereum into their portfolios. Their involvement brings several key benefits:

-

Enhanced Market Stability

Institutional capital generally injects a level of discipline and long-term perspective into crypto markets, reducing wild price swings caused by purely speculative retail trading. -

Improved Infrastructure and Custody Solutions

To meet institutional requirements, sophisticated custody services, regulated exchanges, and robust compliance frameworks have emerged, facilitating safer and more accessible investment vehicles such as Bitcoin ETFs and crypto-backed financial products. -

Deeper Liquidity and Price Discovery

Large transactions executed by institutions contribute to greater liquidity, improving price accuracy and reducing volatility—factors essential for attracting even more participants.

Mainstream Integration by Corporations and Governments

Beyond financial players, corporations are embracing blockchain and crypto assets as part of their business models and payment solutions. Examples include:

- Accepting cryptocurrencies as payment, thereby expanding use cases and user adoption.

- Integrating blockchain technology into supply chain management, data verification, and digital identity.

- Governments exploring or launching central bank digital currencies (CBDCs), signaling official endorsement and sparking innovation in digital fiat infrastructure.

Implications for Growth Potential and Market Dynamics

The interplay between institutional adoption and mainstream acceptance accelerates the maturation of the cryptocurrency ecosystem, fostering:

- Increased investor confidence as regulatory clarity and compliance improve.

- Expansion of financial products and services, such as crypto derivatives, lending platforms, and tokenized assets.

- Greater technological innovation focused on scalability, security, and interoperability driven by enterprise demand.

However, this evolution also introduces active challenges, including the risk of centralization, regulatory scrutiny, and the need to balance privacy with compliance. Overall, the increasing footprint of institutions and mainstream entities is a powerful catalyst for sustainable growth, signaling that cryptocurrencies and blockchain are steadily transitioning from speculative niches to integral components of the global financial system.

Image courtesy of David McBee

Predictions and Expert Opinions on the Next Decade

Looking ahead to 2030, industry thought leaders and blockchain experts forecast a transformative decade for cryptocurrencies and blockchain technology—marked by exponential growth, widespread adoption, and technological breakthroughs that will redefine the digital asset landscape. While the sector remains inherently volatile and subject to regulatory evolution, several prevailing predictions offer valuable insights into the trends poised to shape the crypto ecosystem’s future:

-

Mass Adoption and Integration into Everyday Life

Experts anticipate cryptocurrencies moving beyond niche investment assets to become an integral part of daily financial transactions, remittances, and global commerce. With improved scalability, user-friendly wallets, and government-backed digital currencies, blockchain-based payment systems could rival traditional fiat money in convenience and accessibility. -

Evolution of Web3 and Decentralized Applications (dApps)

The rise of Web3 infrastructure is expected to empower users with greater control over data, identity, and digital assets through decentralized platforms. Innovations around privacy-preserving protocols, advanced smart contracts, and interoperable ecosystems will fuel new decentralized business models, social networks, and content platforms that disrupt centralized incumbents. -

Regulatory Harmonization and Institutional Collaboration

The next decade will likely witness greater global regulatory coordination around crypto assets, fostering safer markets and smoother cross-border transactions. Collaboration between regulators, institutions, and blockchain projects will promote higher standards of transparency and compliance while preserving innovation incentives. -

Sustainable and Energy-Efficient Blockchain Networks

Sustainability will remain a core focus, with the widespread adoption of proof-of-stake, hybrid consensus algorithms, and renewable energy-powered mining operations. This drive will not only address environmental concerns but also enable scalable networks capable of supporting massive user bases without compromising decentralization. -

Emergence of Next-Generation Blockchain Protocols

New blockchain architectures promising greater throughput, faster finality, and enhanced privacy features are expected to enter mainstream use. Layer 1 and 2 innovations combined with breakthroughs in cryptography (such as zero-knowledge proofs and quantum-resistant algorithms) will expand blockchain applicability in industries ranging from finance and healthcare to logistics and governance. -

Expansion of Tokenization and Digital Asset Ecosystems

The tokenization of real-world assets—including real estate, commodities, and intellectual property—is predicted to accelerate, creating liquid, programmable markets that blur the lines between traditional finance and crypto. NFTs and decentralized finance (DeFi) will continue evolving into mature markets, offering novel financial instruments and revenue models.

In summary, the coming decade promises a paradigm shift where blockchain and cryptocurrencies become foundational fabric for digital economy infrastructure, financial inclusion, and new socio-economic innovations. Staying informed about these expert forecasts and emerging trends is crucial for investors, developers, and enthusiasts aiming to capitalize on the unfolding opportunities while navigating challenges in this dynamic space.

Image courtesy of Morthy Jameson