Cross-Border Payments Using Crypto: A Complete Guide

Category: Cryptocurrency

Unlocking the Power of Cross-Border Payments Using Crypto

Navigating cross-border payments can be a labyrinth of high fees, slow transfers, and unpredictable exchange rates, especially for crypto enthusiasts looking to harness digital assets beyond just investment. Whether you’re a seasoned trader, a crypto investor aiming to diversify, or a curious newcomer eager to explore the practical applications of Bitcoin, altcoins, or decentralized finance, understanding how cryptocurrency simplifies international transfers is crucial. You may have arrived here seeking alternatives to traditional banking systems or better ways to send money globally without exorbitant costs and delays. This guide dives deep into the mechanisms, benefits, and challenges of using crypto for cross-border payments—offering you an insightful, layered approach tailored to all experience levels. We'll break down the technical concepts and real-world use cases uniquely, helping you to grasp how blockchain technology reshapes global money movement. Stay with us as we explore innovative trends, regulatory landscapes, security considerations, and future prospects in this rapidly evolving field. This post stands out by combining practical tips with market insights, ensuring you’re equipped to make informed decisions whether managing personal transactions or scaling your crypto ventures.

- Unlocking the Power of Cross-Border Payments Using Crypto

- Understanding Cross-Border Payments: Traditional Methods and Their Challenges

- How Cryptocurrency Transforms Cross-Border Payments

- Popular Cryptocurrencies for International Transfers

- Benefits of Using Crypto for Cross-Border Payments

- Risks and Regulatory Considerations in Crypto Cross-Border Payments

- Crypto Payment Platforms and Wallets: User-Friendly Services for Seamless Cross-Border Transfers

- Integration with Businesses and Remittance Services: How Merchants, Freelancers, and Global Companies Leverage Crypto Payments

- Technical Insights: How Crypto Mining and Network Fees Impact Transaction Speed and Costs in Cross-Border Scenarios

- Future Trends and Innovations: Exploring DeFi Remittances, Blockchain Interoperability, CBDCs, and Scaling Solutions Shaping the Future

- Tips for Safe and Efficient Cross-Border Crypto Payments

Understanding Cross-Border Payments: Traditional Methods and Their Challenges

Cross-border payments have long relied on a network of traditional financial intermediaries such as banks, correspondent banks, and payment processors. These methods typically involve multiple steps, including currency conversion, compliance checks, and settlement processes that impact speed and cost. Common traditional payment options include wire transfers, SWIFT payments, and remittance services like Western Union, all designed to move money internationally but often at significant drawbacks.

Key Challenges in Traditional Cross-Border Payments

-

High Fees: International transfers frequently incur hefty charges. These include intermediary bank fees, service charges by payment providers, and unfavorable exchange rate margins, with total costs sometimes exceeding 10% of the transfer amount.

-

Slow Processing Times: Transactions can take anywhere from several hours to multiple business days to settle due to complex routing and manual reconciliation processes, leading to delays in fund availability.

-

Currency Conversion Complexities: Cross-border payments require converting funds from one currency to another. These conversions add layers of unpredictability because of fluctuating exchange rates and hidden markups imposed by financial institutions.

-

Lack of Transparency: Users often face difficulty tracking their transfers in real-time or understanding the breakdown of fees applied during the process, causing uncertainty and reduced trust.

By appreciating these bottlenecks, it becomes clear why cryptocurrency-powered cross-border payments offer a transformative alternative. Blockchain technology eliminates many traditional pain points by enabling near-instant, low-cost, and transparent transfers without the need for multiple middlemen or currency conversion intermediaries. This shift is especially impactful for international traders, remitters, and global businesses seeking efficiency and cost savings in their transaction flows.

Image courtesy of Audy of Course

How Cryptocurrency Transforms Cross-Border Payments

Cryptocurrency revolutionizes cross-border payments by leveraging blockchain technology, which operates as a decentralized, immutable ledger. Unlike traditional systems dependent on centralized intermediaries, blockchain enables peer-to-peer (P2P) transactions that cut out costly middlemen, significantly reducing fees and settlement times. Each transaction is cryptographically secured and recorded on a public or permissioned blockchain, ensuring transparency and traceability throughout the transfer process.

Decentralization and Peer-to-Peer Networks

At the core of crypto-powered payments is decentralization — networks run by distributed nodes rather than a single authority. This structure enables direct transfers of digital assets globally, avoiding the delays caused by intermediary banks and clearinghouses. Senders and receivers communicate and transact over secure P2P networks, which means:

- Faster settlement: Transactions often finalize within minutes or seconds, regardless of geographic distance or traditional banking hours.

- Lower costs: Fees are minimized, typically involving only nominal network charges, unlike cumulative banking and currency conversion fees.

- Increased accessibility: Individuals without access to formal banking can participate in the financial ecosystem simply by holding a cryptocurrency wallet.

Blockchain’s Role in Streamlining Currency Conversion

Another transformational aspect lies in blockchain's ability to facilitate cross-currency exchange without traditional foreign exchange intermediaries. Stablecoins and cryptocurrency tokens pegged to fiat currencies (like USDT or USDC) allow users to move assets seamlessly across borders while avoiding volatility and hefty conversion costs. Smart contracts automate exchange processes, enabling near-instant currency swaps and programmable payment conditions, making crypto an efficient tool for global commerce and remittances.

By embracing blockchain’s decentralized P2P model, cryptocurrencies overcome many traditional cross-border payment barriers — empowering users with faster, cheaper, and more transparent money transfers worldwide. This evolution not only democratizes international finance but also lays the groundwork for a more inclusive digital economy.

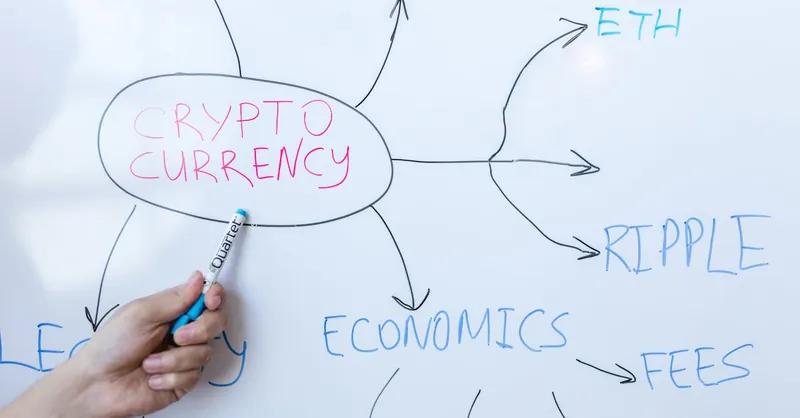

Image courtesy of Jonathan Borba

Popular Cryptocurrencies for International Transfers

When it comes to cross-border payments using crypto, selecting the right cryptocurrency is crucial for maximizing speed, minimizing fees, and ensuring stability. While Bitcoin (BTC) remains the flagship digital asset, several other cryptocurrencies and stablecoins have gained popularity, especially for international money transfers due to their specific advantages in payments and liquidity.

Bitcoin (BTC) – The Pioneer of Digital Gold

Bitcoin is the first and most widely recognized cryptocurrency, often used for international transfers because of its decentralized network security and broad acceptance. Though Bitcoin transactions may occasionally face slower confirmation times and higher fees during network congestion, its unmatched liquidity and extensive exchange support make it a common choice for sending large sums across borders. Additionally, Bitcoin's immutable ledger provides transparency that reduces fraud risk and enhances trust in international settlements.

Stablecoins – Bridging Stability and Speed

Stablecoins like Tether (USDT) and USD Coin (USDC) have become essential for international transfers by addressing the volatility issues commonly associated with cryptocurrencies. These tokens are pegged 1:1 to fiat currencies (primarily the US dollar), offering:

- Price Stability: Eliminates the risk of sudden value drops during transfer times.

- Low Fees and Fast Settlements: Leveraging blockchain efficiencies to deliver quick, cost-effective transfers.

- Wide Exchange Acceptance: Supported on major crypto exchanges and many payment platforms for easy conversion into local currencies.

Stablecoins are particularly favored for remittances and business payments, ensuring recipients receive a stable amount without exposure to crypto market fluctuations.

Altcoins Optimized for Payments

Aside from BTC and stablecoins, several altcoins specifically designed for payments and fast transfers have risen in prominence:

- Litecoin (LTC): Known as the “silver to Bitcoin’s gold,” Litecoin offers faster block generation and lower fees, making it a practical option for small to medium international transfers.

- Ripple (XRP): Designed explicitly for cross-border payments, XRP facilitates near-instant settlements with ultra-low fees by partnering with banking institutions worldwide.

- Stellar Lumens (XLM): Stellar focuses on connecting financial institutions and individuals with interoperability, enabling inexpensive and swift global transactions, favored by many remittance services.

- Algorand (ALGO) and Solana (SOL): These high-throughput blockchains support scalable payment ecosystems with minimal transaction costs, appealing to merchants and businesses operating internationally.

Choosing the Right Crypto for Your Transfer Needs

When determining which cryptocurrency to use for cross-border payments, consider:

| Criteria | Bitcoin (BTC) | Stablecoins (USDT, USDC) | Payment-Optimized Altcoins |

|---|---|---|---|

| Transaction Speed | Moderate (10-60 mins) | Fast (seconds to minutes) | Very Fast (seconds or less) |

| Fees | Variable, can be high | Low to moderate | Low |

| Price Stability | Volatile | Stable (pegged to fiat) | Moderate to high volatility |

| Network Security | Very High | High | High |

| Liquidity & Acceptance | Very High | High | Moderate to High |

Harnessing the benefits of these cryptocurrencies, users can tailor their international transfers based on speed, cost-efficiency, and currency stability, advancing beyond traditional remittance and banking infrastructures. As adoption grows, integrations with DeFi protocols and payment platforms continue to enhance the utility and accessibility of these crypto options for global money movement.

Image courtesy of Jonathan Borba

Benefits of Using Crypto for Cross-Border Payments

Cryptocurrency offers a game-changing solution for cross-border payments by directly addressing the key pain points found in traditional international money transfers. Here’s why using crypto is increasingly becoming the preferred choice for individuals and businesses alike:

1. Lower Fees

One of the most significant advantages of crypto-powered cross-border transactions is the dramatic reduction in fees. Unlike conventional remittances that involve multiple intermediaries—each charging a mark-up—cryptocurrency transfers typically incur only network or blockchain transaction fees, which are substantially lower and often transparent upfront. This cost efficiency is especially impactful for remittance senders, small businesses, and freelancers who rely on cost-effective international payments.

2. Faster Settlement Times

Traditional cross-border payments can take several days due to intermediary processing, banking hours, and regulatory compliance. Crypto transactions, however, leverage blockchain’s peer-to-peer network architecture, allowing near-instantaneous confirmations in many cases—ranging from just a few seconds to minutes. This rapid settlement accelerates cash flow, enabling faster access to funds globally regardless of time zones or holidays.

3. Enhanced Transparency and Security

Blockchain’s inherent transparency ensures that every transaction is recorded on an immutable ledger accessible to all network participants. This feature dramatically improves real-time tracking of payments and eliminates ambiguous fee structures that plague traditional systems. Additionally, the cryptographic security underlying cryptocurrency transactions reduces risks associated with fraud, chargebacks, and unauthorized access, making it a safer alternative for sending money internationally.

4. Greater Accessibility and Financial Inclusion

Cryptocurrency enables anyone with a digital wallet and internet connection to send and receive money globally instantly, bypassing the need for traditional bank accounts or credit checks. This opens financial services to unbanked or underbanked populations across developing regions, fostering financial inclusion. Moreover, it empowers global freelancers, cross-border workers, and diaspora communities to transact efficiently without reliance on cumbersome legacy infrastructures.

Together, these benefits position crypto cross-border payments as a faster, cheaper, and more transparent alternative to conventional banking and remittance solutions, paving the way for a more accessible and inclusive global financial ecosystem.

Image courtesy of RDNE Stock project

Risks and Regulatory Considerations in Crypto Cross-Border Payments

While cryptocurrency offers compelling advantages for international money transfers, it is essential to understand the risks and regulatory challenges that accompany its use, especially in cross-border contexts. Addressing these concerns is critical for individuals and businesses seeking to leverage crypto while remaining compliant and protected.

Volatility Risks

Despite the rise of stablecoins, cryptocurrency volatility remains a significant risk in cross-border payments involving assets like Bitcoin or altcoins. Price fluctuations can impact the value transferred between sender and recipient, potentially causing losses or reduced purchasing power. To mitigate this volatility risk:

- Opt for stablecoins pegged to fiat currencies when possible.

- Use fast settlement networks to minimize exposure time.

- Employ hedging strategies or convert crypto to local fiat promptly after receipt.

Understanding and managing volatility is key to ensuring predictable and reliable international transactions using crypto.

Compliance Challenges: AML and KYC Regulations

Cross-border crypto payments intersect with multiple Anti-Money Laundering (AML) and Know Your Customer (KYC) regulatory frameworks worldwide. Financial authorities require transactions to be monitored to prevent illicit activities such as money laundering, terrorism financing, and fraud. Key considerations include:

- Identity Verification: Many exchanges and payment service providers enforce KYC protocols to verify sender and receiver identities.

- Transaction Monitoring: Crypto platforms may flag suspicious patterns and conduct compliance reviews.

- Reporting Obligations: Entities might be required to report transactions exceeding certain thresholds to regulatory bodies.

Failing to comply with these regulations can lead to penalties, frozen funds, or blocked transfers. Hence, users should choose reputable crypto service providers that adhere to local and international AML/KYC standards.

Varying Country Policies and Legal Uncertainty

Regulatory landscapes for cryptocurrencies vary widely across different countries and jurisdictions, creating complexity for cross-border payments:

- Some nations embrace crypto adoption with clear legal frameworks supporting its use.

- Others impose restrictions or outright bans on cryptocurrency transactions and exchanges.

- Emerging policies can introduce sudden regulatory changes, impacting the usability or legality of cross-border crypto transfers.

Before sending or receiving payments internationally via crypto, it is crucial to research the regulatory status in both the sender’s and recipient’s countries. Staying informed helps avoid potential legal issues and ensures smoother transaction flows.

By navigating these risks and regulatory considerations carefully, users can harness the benefits of crypto for cross-border payments while safeguarding their operations and complying with global financial standards. This balanced approach allows individuals and businesses to confidently participate in the growing digital economy.

Image courtesy of RDNE Stock project

Crypto Payment Platforms and Wallets: User-Friendly Services for Seamless Cross-Border Transfers

Navigating cross-border payments with cryptocurrency is made significantly easier thanks to an expanding ecosystem of crypto payment platforms and digital wallets tailored for all experience levels. These tools not only facilitate rapid and cost-effective international transfers but also provide intuitive interfaces, robust security, and integration with multiple cryptocurrencies and fiat gateways—empowering users from beginners to seasoned investors to transact globally with confidence.

Top Crypto Payment Platforms for Cross-Border Transfers

-

Coinbase Commerce: Ideal for merchants and individuals seeking a simple, secure payment gateway, Coinbase Commerce supports major cryptocurrencies and enables instant receipt of funds directly into personal wallets, removing delays typical of bank settlements. Its user-friendly dashboard and detailed reporting make it accessible for new users entering the crypto payments landscape.

-

BitPay: A pioneer in crypto payment processing, BitPay offers solutions for both consumers and businesses to send and receive digital assets internationally. With features like multi-currency invoicing, settlement in local fiat currencies, and Visa prepaid cards, BitPay combines convenience with regulatory compliance, helping users reduce cross-border friction.

-

Binance Pay: Leveraging the massive Binance ecosystem, Binance Pay allows easy, no-fee crypto transfers between accounts worldwide. Its streamlined interface and support for more than 30 cryptocurrencies make it a versatile choice for fast and fee-less international payments suited to users at any experience level.

User-Friendly Crypto Wallets Facilitating Cross-Border Payments

-

Exodus Wallet: Known for a polished, intuitive design, Exodus supports a wide range of cryptocurrencies and integrates with decentralized exchanges, allowing users to swap tokens instantly before sending across borders. The wallet’s focus on accessibility makes it a great entry point for beginners making international transfers.

-

Trust Wallet: A mobile-first wallet supporting multiple blockchains, Trust Wallet is ideal for users who want control over private keys and seamless access to DeFi and token swap features. Its ease of use and cross-border transfer capabilities empower both newcomers and advanced users to send crypto globally with minimal hassle.

-

MetaMask: Although primarily a browser-based wallet geared toward Ethereum and DeFi, MetaMask’s expanding support for multiple chains enables users to manage and transfer a variety of assets globally. Its integration with numerous payment platforms and decentralized applications makes it a powerful tool for cross-border crypto transactions aimed at tech-savvy users.

Features to Look For in Crypto Payment Tools

When choosing platforms and wallets for cross-border crypto payments, prioritizing the following features ensures efficiency, security, and usability:

- Multi-cryptocurrency support: Flexibility to send and receive popular coins and stablecoins.

- Low transaction fees and fast settlement: Minimizing costs and delays when transferring funds internationally.

- Regulatory compliance: KYC/AML adherence to avoid blocked transfers and legal complications.

- User-friendly interface: Simplified processes and clear instructions suited for beginners and pros alike.

- Security: Robust private key management, two-factor authentication, and secure backups.

- Integration with fiat gateways: Easy on/off-ramp options to convert crypto to local currencies when needed.

By leveraging these crypto payment platforms and wallets, users can harness the full benefits of blockchain-powered cross-border transfers—including speed, transparency, and reduced costs—while enjoying seamless, secure experiences tailored to their level of expertise. Whether you are sending funds to family abroad, paying international suppliers, or managing freelance payments worldwide, the right crypto tools open up a world of efficient financial possibilities.

Image courtesy of Roger Brown

Integration with Businesses and Remittance Services: How Merchants, Freelancers, and Global Companies Leverage Crypto Payments

As cryptocurrency adoption grows, businesses and remittance services worldwide are increasingly integrating crypto payments to streamline cross-border transactions. Merchants, freelancers, and multinational companies benefit from the unique advantages of blockchain-based transfers, including reduced fees, faster settlement, and simplified reconciliation processes, all of which enhance global commerce efficiency.

Merchants Embracing Crypto for Global Sales

Many online and brick-and-mortar merchants now accept cryptocurrencies like Bitcoin, Ethereum, and stablecoins as payment for goods and services. By integrating crypto payment gateways such as Coinbase Commerce, BitPay, or NOWPayments, businesses can:

- Expand their international customer base by accepting payments without worrying about currency conversions or high transaction fees.

- Reduce chargeback and fraud risks due to the immutable and transparent nature of blockchain transactions.

- Benefit from faster settlements, improving cash flow by avoiding the traditional 2-5 day bank transfer delays.

- Access new markets with limited banking infrastructure, enabling seamless sales even in regions with unstable financial services.

This adoption is especially impactful for e-commerce platforms, subscription services, and digital goods providers, who can effortlessly accept cross-border payments while maintaining compliance with global financial regulations.

Freelancers and Remote Workers Getting Paid Globally

Freelancers and independent contractors operating internationally face challenges with payment delays, high fees, and complicated bank requirements when receiving funds from foreign clients. Cryptocurrencies eliminate these hurdles by enabling:

- Instant global payments directly to personal crypto wallets, bypassing intermediaries and costly conversion fees.

- Borderless financial freedom where freelancers can demand payment in cryptocurrencies or stablecoins, protecting their income from volatile exchange fluctuations.

- Enhanced privacy and security with non-custodial wallets that give full control over funds without relying on banking institutions.

Popular freelance platforms are beginning to integrate crypto payout options, while peer-to-peer agreements leveraging smart contracts further automate and secure cross-border transactions. This evolution empowers the growing gig economy to operate transparently and efficiently on a global scale.

How Global Companies Use Crypto to Optimize Treasury and Remittance Operations

Large multinational corporations and remittance providers also leverage cryptocurrencies to reduce costs and complexity in international money movements:

- Corporate Treasury Management: Companies utilize crypto and stablecoins to manage liquidity across borders, settle invoices faster, and hedge against currency risks through programmable contracts.

- Cross-Border Payrolls: Paying international employees or contractors in cryptocurrency cuts down payroll processing times and bank charges, especially in emerging markets.

- Streamlined Remittance Services: Fintech firms and remittance companies integrate blockchain technology and stablecoins to offer customers affordable, near-instant international money transfer options without traditional banking bottlenecks.

By adopting crypto-powered solutions, businesses improve operational efficiency, foster closer supplier relationships, and deliver enhanced value to global customers and immigrant communities relying on remittances.

Embracing cryptocurrency in business and remittance workflows marks a powerful shift toward frictionless cross-border payments—reducing costs, speeding up settlements, and unlocking new economic opportunities in an increasingly interconnected world.

Image courtesy of Jonathan Borba

Technical Insights: How Crypto Mining and Network Fees Impact Transaction Speed and Costs in Cross-Border Scenarios

Understanding the technical underpinnings of cryptocurrency transactions is essential for grasping why mining activity and network fees directly affect the speed and cost of cross-border payments. At the core, cryptocurrencies operate on decentralized blockchains maintained by miners or validators who verify and record transactions in exchange for fees and block rewards. This dynamic plays a crucial role in determining the efficiency of crypto payments across borders, especially during periods of high network demand.

The Role of Crypto Mining and Validators in Transaction Processing

In many cryptocurrencies such as Bitcoin and Ethereum (pre-2.0), transactions are processed through a mechanism called Proof of Work (PoW) mining. Miners compete to solve complex cryptographic puzzles to add new blocks to the blockchain. Each block contains multiple transactions, and since block space is limited, miners prioritize transactions with higher fees:

- Transaction Prioritization: To secure faster confirmations, senders can include higher network fees, incentivizing miners to include their transaction in the next block.

- Network Congestion Effects: When many users transact simultaneously—such as during market surges or major events—average fees rise, and confirmation times can lengthen, since miners pick the highest-fee transactions first.

- Cross-Border Implications: For international payments, this means that during busy periods, delays and elevated fees might reduce the cost-efficiency advantage crypto offers over traditional methods, although these issues tend to be shorter-term and network-dependent.

Other consensus mechanisms like Proof of Stake (PoS), used by newer blockchains (e.g., Ethereum 2.0, Solana, Algorand), rely on validators rather than miners, reducing energy consumption and often improving transaction throughput and fee stability. This evolution in blockchain technology is driving faster and cheaper cross-border crypto payments, essential for scaling global adoption.

Network Fees: Balancing Cost and Speed in Cross-Border Transfers

Network fees—sometimes called gas fees or transaction fees—are paid to incentivize validators or miners to process transactions. These fees fluctuate based on network activity, blockchain design, and token economics:

- Low Fees = Slower Transactions: If users opt for minimal fees, their transactions may experience slower confirmations as miners prioritize higher-fee transactions.

- Higher Fees = Faster Settlements: By paying competitive or priority fees, cross-border payments can settle in seconds or minutes, crucial for businesses and individuals needing urgent fund transfers.

- Stablecoins and Layer 2 Solutions: Many cross-border payment users leverage stablecoins on blockchains with low transaction fees or use Layer 2 scaling solutions (like Lightning Network for Bitcoin or rollups for Ethereum) to cut fee costs drastically while enjoying near-instant settlement times.

Key Takeaways for Efficient Crypto Cross-Border Payments

To optimize transaction speed and cost when sending crypto internationally, consider the following:

| Factor | Impact on Cross-Border Payments |

|---|---|

| Network Congestion | High congestion increases fees and confirmation times |

| Blockchain Consensus Type | PoS networks usually offer faster, cheaper transactions |

| Fee Levels Chosen by Sender | Higher fees usually mean quicker transaction processing |

| Use of Layer 2 / Sidechains | Enables scalability, lower fees, and faster settlements |

| Stablecoin vs Native Token | Stablecoins can avoid volatility but may have varying fees depending on the blockchain |

By staying aware of these technical aspects, crypto users can strategically select blockchain networks, timing, and fee settings to ensure cost-effective and timely cross-border payments. This insight is fundamental for leveraging cryptocurrency beyond speculation to become a truly practical global payment solution.

Image courtesy of Roger Brown

Future Trends and Innovations: Exploring DeFi Remittances, Blockchain Interoperability, CBDCs, and Scaling Solutions Shaping the Future

As the crypto ecosystem matures, several cutting-edge innovations and future trends are poised to revolutionize cross-border payments, further enhancing speed, affordability, and accessibility on a global scale. Among the most transformative developments are Decentralized Finance (DeFi) remittances, blockchain interoperability protocols, Central Bank Digital Currencies (CBDCs), and advanced scaling solutions. Understanding these trends is essential for anyone interested in the evolving landscape of international crypto transfers.

DeFi Remittances: Unlocking Permissionless Global Money Transfers

Decentralized Finance platforms are pioneering a new wave of peer-to-peer remittance services that eliminate traditional intermediaries like banks and money transfer operators altogether. By leveraging smart contracts on blockchains such as Ethereum, Binance Smart Chain, and Solana, DeFi remittance protocols enable users to send and receive funds globally with:

- Near-instant settlement times, bypassing delays inherent in legacy systems.

- Minimal fees due to the absence of correspondent banks or remittance agents.

- Enhanced transparency through on-chain transaction tracking.

- Programmable payment options, such as scheduled payments or escrow services, improving trust and reducing fraud risk.

This shift not only democratizes cross-border payments but also offers a more inclusive financial ecosystem for unbanked populations and migrant workers who rely heavily on remittance income.

Blockchain Interoperability: Bridging Multiple Networks for Seamless Transfers

One of the biggest challenges in cross-border crypto payments today is the fragmentation caused by numerous blockchains operating in silos. Blockchain interoperability protocols like Polkadot, Cosmos, and cross-chain bridges are addressing this by enabling the seamless transfer of assets and data across different networks. The benefits include:

- Dollar-cost efficiency by selecting the fastest and cheapest chain for transactions.

- Broader asset accessibility, allowing users to transact in a variety of cryptocurrencies without native chain limitations.

- Improved liquidity aggregation, crucial for large cross-border payments and business cash flows.

Interoperability ensures that cross-border payments are no longer restricted by the underlying blockchain technology, thereby unlocking a truly unified decentralized financial network.

Central Bank Digital Currencies (CBDCs): The New Frontier in Cross-Border Payments

As governments worldwide explore CBDCs, these state-backed digital currencies are expected to play a significant role in future international transactions. CBDCs aim to:

- Integrate with existing blockchain infrastructure to facilitate instant and secure cross-border settlements.

- Reduce foreign exchange friction through programmable currency exchanges and standardized protocols.

- Enhance regulatory oversight while maintaining efficient compliance through built-in KYC/AML features enabled by central banks.

The harmonization of CBDCs with crypto payment rails could deliver next-generation cross-border payment solutions that combine the benefits of digital assets with the stability and trust of sovereign currencies.

Scaling Solutions: Layer 2 and Beyond for Ultra-Fast, Low-Cost Payments

To tackle blockchain scalability issues limiting transaction throughput and raising fees, Layer 2 scaling solutions and alternative consensus mechanisms are rapidly advancing. Popular approaches such as the Lightning Network (Bitcoin), Rollups (Ethereum), and Optimistic and ZK Rollups significantly increase transaction speeds and lower costs—both critical for cross-border crypto usage by:

- Enabling micropayments and mass adoption without compromising security.

- Reducing congestion on primary chains to maintain affordability even during peak demand.

- Supporting complex transaction types like batch payments and multi-hop routes that benefit global payrolls, supplier payments, and remittances.

Combining these scaling innovations with interoperable blockchains and DeFi protocols creates a robust infrastructure capable of handling exponential growth in worldwide crypto payments.

These future trends and innovations underscore an exciting potential for cryptocurrency to redefine cross-border payments by unlocking unprecedented levels of efficiency, inclusivity, and regulatory compatibility. Staying informed about these developments equips you to harness emerging opportunities amid the rapidly evolving global fintech landscape.

Image courtesy of Jonathan Borba

Tips for Safe and Efficient Cross-Border Crypto Payments

When sending cryptocurrency across borders, security and efficiency go hand in hand to ensure your funds arrive intact, on time, and at minimal cost. Whether you’re a first-time user or a seasoned crypto enthusiast, adopting best practices will help you navigate risks, choose reliable platforms, and optimize transaction speed without sacrificing safety.

Prioritize Security to Protect Your Funds

-

Use Reputable Wallets and Platforms: Always transact through well-established wallets and exchanges with transparent security protocols, such as multi-factor authentication (MFA), hardware wallet compatibility, and solid user reviews. This reduces the risk of hacks, phishing, and fraudulent withdrawals.

-

Double-Check Recipient Addresses: Crypto transactions are irreversible. Ensure the receiving address is correct by copying it carefully and, if possible, verifying via a trusted channel (e.g., direct communication). Sending funds to the wrong address can result in permanent loss.

-

Enable Two-Factor Authentication and Secure Backups: Protect your accounts with 2FA and maintain encrypted backups of private keys or seed phrases offline. Never share your private keys or sensitive credentials with anyone.

-

Beware of Phishing Attempts and Scams: Stay vigilant against suspicious links, unsolicited messages, and fake services promising guaranteed returns or discounted fees. Always verify sources before clicking or approving transactions.

Choose the Right Platforms for Cross-Border Transfers

Selecting a crypto payment provider that supports your target currencies, jurisdictions, and compliance requirements is critical for seamless international transfers:

- Check Regulatory Compliance: Platforms compliant with AML/KYC regulations help reduce the risk of blocked transactions and legal complications.

- Examine Supported Cryptocurrencies and Fiat Gateways: Pick services that offer the cryptocurrencies suitable for your transfer (e.g., stablecoins for volatility reduction) and convenient fiat on/off-ramps in recipient countries.

- Review Fee Structures and Transfer Speeds: Transparent fee schedules and fast settlement options enable better cost management and timing precision.

- Look for Customer Support and User Ease: Responsive customer service and intuitive interfaces improve your overall transaction experience, especially when troubleshooting is needed.

Manage Risks Effectively for Smooth Operations

In addition to security and platform choice, managing ancillary risks helps enhance the efficiency and reliability of cross-border crypto payments:

- Monitor Network Conditions: Before sending funds, check the current network congestion and gas fees on your chosen blockchain to avoid unexpectedly high costs or delays.

- Leverage Stablecoins for Predictability: Using stablecoins pegged to fiat currencies reduces exposure to price volatility during transfers, ensuring recipients get expected amounts.

- Set Transaction Priorities with Appropriate Fees: Determine the urgency of your transfer and adjust network fees accordingly—higher fees usually yield faster confirmations.

- Stay Updated on Regulatory Changes: Keep informed about legal developments in both sender and recipient countries to ensure compliance and prevent disruptions.

- Use Multi-Signature or Escrow Services for Large Transfers: When handling significant cross-border payments, multi-sig wallets or smart contract-based escrow add an extra layer of security and trust.

By integrating these best practices for safe and efficient cross-border crypto payments, users can confidently leverage cryptocurrency’s advantages while minimizing risks, delays, and unexpected costs. This strategic approach empowers you to maximize the potential of crypto as a transformative tool for global money transfers.

Image courtesy of Elise