Beginner's Guide to Bitcoin: Unlocking Crypto Basics

Category: Cryptocurrency

Unlocking the Basics: Your Essential Beginner's Guide to Bitcoin

If you’re new to cryptocurrency or looking to strengthen your understanding of Bitcoin, you’ve come to the right place. Bitcoin has evolved from a niche digital asset to a global phenomenon reshaping finance and investment. However, for newcomers, Bitcoin’s complex jargon and underlying technology can be a daunting barrier. Whether you’re curious about how Bitcoin works, how to buy and store it safely, or its role in the broader crypto market, this guide simplifies these concepts without overwhelming technical detail.

Many beginners land here craving trustworthy, clear, and actionable insights that fit all experience levels — from casual crypto enthusiasts to cautious first-time investors. You might wonder how Bitcoin mining works, what wallets you should trust, or how speculative trends affect your investments. This blog post cuts through the noise by breaking down Bitcoin’s technology, economics, security, and market dynamics in a logical, easy-to-follow manner.

Through this comprehensive beginner’s guide, you’ll gain a solid foundation to confidently explore Bitcoin, altcoins, and mining opportunities. Unlike other generic articles, this post balances educational depth with practical hints, helping you navigate the crypto space with clarity and confidence. Read on to transform Bitcoin from a buzzword into a valuable component of your financial knowledge.

- Unlocking the Basics: Your Essential Beginner's Guide to Bitcoin

- What is Bitcoin? Understanding the Digital Currency Revolution

- How Bitcoin Works: Blockchain Technology Simplified

- Buying and Selling Bitcoin: A Step-by-Step Guide

- Bitcoin Wallets Explained: Keeping Your Crypto Safe

- Bitcoin Mining Basics: How New Coins Are Created

- Understanding Bitcoin’s Volatility and Price Drivers

- Bitcoin and Regulation: What Beginners Need to Know

- Risks and Rewards: Navigating Bitcoin Investment Challenges

- The Future of Bitcoin and Its Role in Finance

- Resources and Tools for Bitcoin Beginners: Stay Informed and Connected

What is Bitcoin? Understanding the Digital Currency Revolution

Bitcoin is the world’s first decentralized digital currency, introduced in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. Unlike traditional money issued by governments or banks, Bitcoin operates on a peer-to-peer network without a central authority, making it borderless, censorship-resistant, and transparent. At its core, Bitcoin is both a form of money and a revolutionary technological breakthrough that enables secure, irreversible transactions directly between users anywhere in the world.

The basic concept behind Bitcoin is simple yet powerful: it uses blockchain technology, a public ledger that records all transaction data in a way that is tamper-proof and verifiable by anyone. This ledger runs on thousands of computers globally, ensuring no single entity controls or manipulates the currency. Bitcoin’s supply is also limited to 21 million coins, introducing scarcity that mimics precious metals like gold, which many investors refer to as "digital gold."

Understanding why Bitcoin matters comes down to its ability to disrupt traditional financial systems by offering:

- Financial sovereignty: You control your money without relying on banks or intermediaries.

- Lower transaction fees: Especially for cross-border payments, Bitcoin can be faster and cheaper than traditional methods.

- Inflation resistance: Its fixed supply protects against the devaluation common with fiat currencies.

- Access to global finance: People without bank accounts or in unstable economies can store and transfer wealth securely.

This revolutionary blend of technology and economics is why Bitcoin has captured global attention as both a store of value and a new form of money that challenges the status quo. As you continue exploring, you'll see how this digital currency lays the foundation for a rapidly evolving crypto ecosystem, offering unprecedented opportunities and risks alike.

Image courtesy of RDNE Stock project

How Bitcoin Works: Blockchain Technology Simplified

At the heart of Bitcoin’s revolutionary design lies blockchain technology, a decentralized and transparent digital ledger that records every transaction ever made on the network. Unlike traditional ledgers maintained by banks or financial institutions, Bitcoin's blockchain is distributed across thousands of computers (called nodes) worldwide, ensuring no single point of failure or control. This decentralized structure means that every participant on the network holds a copy of the entire transaction history, enhancing security and trust without relying on intermediaries.

Blockchain: The Digital Ledger Explained

Think of the blockchain as a chain of blocks, where each block contains a batch of verified transactions. These blocks are linked together in chronological order, forming an immutable record that cannot be altered retroactively without consensus from the network. Every 10 minutes (on average), miners compete to add a new block to the chain by solving complex mathematical puzzles—a process called proof-of-work. This validation ensures that transactions are legitimate, prevents double-spending, and secures the network against fraud.

Decentralization and Why It Matters

Bitcoin’s decentralization is a core feature that differentiates it from traditional currencies. Without a central authority, the network operates on consensus, meaning all participants must agree on the state of the blockchain. This collective verification guarantees that:

- Transactions are transparent and public: Anyone can view the ledger, promoting trust through openness.

- No single entity can manipulate the system: The distributed design prevents censorship or shutdown.

- Security is robust: Altering past transactions would require controlling over 50% of the network’s computing power—a feat practically impossible for large networks like Bitcoin.

By utilizing blockchain and decentralization, Bitcoin eliminates the need for banks or middlemen to process payments, enabling users to send and receive money directly, swiftly, and securely anywhere in the world.

Transaction Verification Simplified

When you send Bitcoin, your transaction is broadcast to the network where miners pick it up, verify the authenticity (checking digital signatures and ensuring you have enough balance), and bundle it into a new block. Once a block is confirmed and added to the blockchain, your transaction becomes irreversible and visible to all users. This trustless verification system leverages cryptography and game theory to ensure honest participation and transaction integrity without relying on traditional institutions.

Understanding these fundamentals of blockchain technology and decentralization gives you the foundation to comprehend how Bitcoin achieves its goals of security, transparency, and financial sovereignty, making it a groundbreaking innovation in the world of digital money.

Image courtesy of Jonathan Borba

Buying and Selling Bitcoin: A Step-by-Step Guide

Once you understand what Bitcoin is and how it works, the next essential step is knowing how to buy and sell Bitcoin safely and efficiently. Whether you’re purchasing your first Bitcoin or planning to trade regularly, it’s crucial to choose the right platforms, payment methods, and understand transaction fees to optimize your experience.

Choosing the Right Bitcoin Exchange

The easiest way for beginners to buy Bitcoin is through a cryptocurrency exchange—an online platform where you can trade your local currency for Bitcoin and vice versa. Here’s what to consider when choosing an exchange:

- Reputation and Security: Look for exchanges with strong security measures (like two-factor authentication), transparent histories, and regulatory compliance to protect your funds.

- User Interface: A clean, user-friendly interface helps beginners navigate buying and selling processes without confusion.

- Available Payment Methods: Check whether the exchange supports preferred payment options such as bank transfers, credit/debit cards, or even PayPal.

- Supported Currencies: Some exchanges allow you to trade Bitcoin directly with various fiat currencies or altcoins, increasing flexibility.

- Geographic Availability: Not all exchanges operate globally—ensure the platform services your country and complies with local regulations.

Popular beginner-friendly exchanges include Coinbase, Binance, Kraken, and Gemini, each offering a balance of security, ease of use, and competitive fees.

Payment Methods for Buying Bitcoin

Your choice of payment method can impact transaction speed, fees, and convenience. Common methods include:

- Bank Transfers: Usually low-cost and secure but may take 1-3 business days to process.

- Credit/Debit Cards: Instant purchases but often come with higher fees.

- Peer-to-Peer (P2P) Marketplaces: Direct buying/selling from individuals, sometimes with more payment options but requiring extra caution to avoid scams.

- Payment Apps: Some exchanges support PayPal or similar apps, providing convenience but varying availability.

Understanding Transaction Fees

Fees vary widely depending on the exchange, payment method, and network congestion:

- Exchange Fees: Most platforms charge a commission (typically 0.1%-1%) per transaction. Look for transparent fee structures.

- Deposit/Withdrawal Fees: Some exchanges add fees when you deposit or withdraw funds.

- Bitcoin Network Fees: Every Bitcoin transaction incurs a miner’s fee, fluctuating based on blockchain demand—higher fees result in faster confirmations.

Before making any trade, compare total costs to ensure you get the best value.

By carefully selecting your exchange, payment options, and being mindful of fees, you’ll execute Bitcoin transactions with confidence and efficiency. This foundational knowledge empowers you to safely enter the exciting world of Bitcoin investing and trading.

Image courtesy of Photo By: Kaboompics.com

Bitcoin Wallets Explained: Keeping Your Crypto Safe

Once you’ve bought Bitcoin, the next critical step is choosing the right Bitcoin wallet to store and manage your cryptocurrency securely. A wallet is more than just a digital piggy bank—it’s the key to accessing your funds, making transactions, and safeguarding your investment against theft or loss. Understanding the different types of wallets and best security practices is essential for every Bitcoin user, especially beginners.

Types of Bitcoin Wallets

Bitcoin wallets typically fall into two broad categories: hot wallets and cold wallets. Each serves different purposes depending on your needs for convenience, security, and accessibility.

- Hot Wallets

These wallets are connected to the internet, making them convenient for frequent transactions and easy access. They include: - Mobile wallets: Apps on your smartphone, perfect for on-the-go payments.

- Desktop wallets: Software installed on your computer, offering greater control with moderate security risks.

- Web wallets: Online services accessible via browsers, very user-friendly but reliant on third-party security.

Pros: Fast transaction times, user-friendly, ideal for daily use.

Cons: More vulnerable to hacks due to constant internet connectivity.

- Cold Wallets

Cold wallets keep your Bitcoin offline, vastly reducing exposure to hacking risks. They mainly include: - Hardware wallets: Physical devices like Ledger or Trezor storing your private keys securely offline.

- Paper wallets: Printed QR codes or keys, completely offline and immune to digital threats if stored safely.

Pros: Highest security, immune to online attacks, ideal for long-term storage.

Cons: Less convenient for frequent transactions, requires careful physical safeguarding.

Comparing Wallets: What’s Best for You?

| Wallet Type | Security Level | Convenience | Ideal Use Case |

|---|---|---|---|

| Hot Wallets | Moderate | High | Daily transactions, small amounts |

| Hardware Wallets | Very High | Moderate | Long-term holding, large sums |

| Paper Wallets | Very High (if safe) | Low | Cold storage, backup purposes |

| Web Wallets | Low to Moderate | Very High | Beginners or casual users |

Best Security Practices for Bitcoin Wallets

Protecting your Bitcoin starts with adopting strong security habits regardless of wallet choice:

- Never share your private keys or seed phrases. These give full control of your Bitcoin.

- Enable two-factor authentication (2FA) on wallets and exchange accounts.

- Regularly back up your wallet’s recovery phrase and store backups in multiple secure locations.

- Keep hardware wallets in a safe place, away from moisture, extreme temperatures, and unauthorized access.

- Be cautious of phishing attempts, fake wallet apps, and suspicious websites.

- Consider splitting your Bitcoin holdings between hot and cold wallets to balance security and convenience.

By understanding how Bitcoin wallets work and implementing strong security measures, you gain full control over your cryptocurrency assets while minimizing risks. Whether you’re a casual user or planning to hold Bitcoin as a long-term investment, selecting the right wallet and safeguarding your private keys ensures your crypto journey is both safe and enjoyable.

Image courtesy of Worldspectrum

Bitcoin Mining Basics: How New Coins Are Created

Bitcoin mining is the process that powers the Bitcoin network, enabling the creation of new coins while securing and validating transactions. At its core, mining involves specialized computers solving complex mathematical problems to add new blocks to the blockchain—a method known as proof-of-work (PoW). This process not only confirms transactions but also ensures the integrity and security of the decentralized ledger without needing a central authority.

How Mining Works: Proof-of-Work Explained

Miners compete to solve cryptographic puzzles based on the transaction data in a candidate block. The first miner to find a valid solution broadcasts their block to the network, where other nodes verify it before appending it to the blockchain. The PoW algorithm requires substantial computational effort, making it extremely difficult to alter past transactions and preventing double-spending fraud. This competitive mechanism incentivizes honest participation and maintains trust in the network.

Mining Rewards: Incentives for Miners

Successful miners receive two types of rewards that fuel the Bitcoin economy:

-

Block Reward: New bitcoins are minted and awarded to the miner who solves the block. Initially set at 50 BTC per block, this reward halves approximately every four years (roughly every 210,000 blocks) in an event called the halving, currently at 6.25 BTC (as of 2024). This limited issuance enforces Bitcoin’s fixed supply cap of 21 million coins, introducing scarcity that supports its value over time.

-

Transaction Fees: Miners also collect fees attached to each transaction included in the block. As block rewards diminish over time, these fees will play an increasingly important role in motivating miners to maintain network security.

Energy Considerations and Environmental Impact

Bitcoin mining’s proof-of-work system requires significant electricity, fueling concerns about environmental sustainability. This high energy consumption is due to the massive amounts of computational power needed to solve mining puzzles and secure the network. However, the industry is evolving rapidly:

- Many mining operations now utilize renewable energy sources like hydro, solar, and wind power to reduce carbon footprints.

- Advances in mining hardware have improved energy efficiency dramatically over the years.

- Alternative consensus mechanisms (used by other cryptocurrencies) are exploring less energy-intensive security models, but Bitcoin’s robust security remains rooted in PoW reliability.

Understanding these energy considerations helps beginners grasp the balance between Bitcoin’s security benefits and its environmental challenges. Mining remains a cornerstone of the Bitcoin ecosystem, vital for creating new coins, verifying transactions, and maintaining the network’s decentralized trust.

Image courtesy of Leeloo The First

Understanding Bitcoin’s Volatility and Price Drivers

Bitcoin is famously known for its high price volatility, often experiencing significant price swings within short periods. This volatility can be both an opportunity and a risk for investors and traders, especially beginners. Understanding what drives these fluctuations is essential to navigating the Bitcoin market with confidence and making informed decisions.

Key Factors Influencing Bitcoin’s Price Volatility

-

Market Speculation and Sentiment

A large portion of Bitcoin’s price movements is driven by market speculation. Because Bitcoin is still a relatively young asset class with a limited history, prices can be highly sensitive to news events, influential opinions, social media trends, and investor sentiment. Positive developments like adoption by major companies or countries can trigger rapid price surges, while regulatory crackdowns or security breaches often cause sharp declines. -

Supply and Demand Dynamics

Bitcoin’s fixed maximum supply of 21 million coins introduces a fundamental scarcity that supports its value over time. However, the actual circulating supply combined with fluctuating demand plays a critical role in price discovery: -

When demand outpaces supply, prices tend to rise.

-

Conversely, if demand wanes or large holders (whales) sell significant quantities, prices can drop quickly.

-

Liquidity and Market Maturity

Compared to traditional financial markets, Bitcoin’s liquidity is still developing. Lower liquidity means that even relatively small buy or sell orders can lead to substantial price swings. Additionally, the presence of leveraged trading and derivatives products on exchanges amplifies volatility through margin calls and forced liquidations. -

External Macro and Regulatory Influences

Bitcoin does not exist in isolation; it is affected by broader economic and geopolitical factors. Some external influences include: -

Regulatory announcements: Government policies or bans on cryptocurrency trading impact investor confidence worldwide.

- Macroeconomic trends: Inflation rates, monetary policies, and currency devaluation can increase interest in Bitcoin as a hedge.

- Technological developments: Upgrades to the Bitcoin protocol or breakthroughs in competing blockchain projects can sway market perception.

By grasping these price drivers and the sources of volatility, beginners can better anticipate market movements, develop risk management strategies, and avoid impulsive decisions based on short-term changes. Remember, while volatility offers trade opportunities, a long-term perspective aligned with Bitcoin’s underlying scarcity and adoption trends often provides a more stable path through its unpredictable price cycles.

Image courtesy of Tima Miroshnichenko

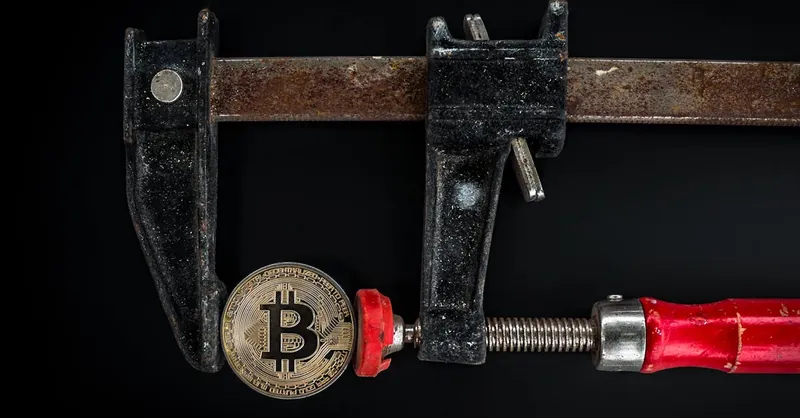

Bitcoin and Regulation: What Beginners Need to Know

As Bitcoin continues to gain mainstream adoption, understanding the global regulatory landscape is crucial for beginners to navigate legal considerations and tax implications effectively. Regulatory approaches to Bitcoin vary widely across countries, ranging from full acceptance as a legitimate asset to outright bans. Governments primarily focus on preventing money laundering, fraud, and tax evasion, while also seeking to protect consumers and maintain financial stability.

Key Legal Considerations for Bitcoin Users

- KYC and AML Compliance: Most countries require cryptocurrency exchanges and service providers to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This means you will typically need to verify your identity before buying, selling, or withdrawing Bitcoin on regulated platforms.

- Legal Status: Bitcoin's classification differs globally—some jurisdictions recognize it as a commodity, others as a currency or digital asset, which impacts how it is regulated and taxed.

- Bans and Restrictions: A few countries impose strict restrictions or bans on cryptocurrency usage and trading. Staying informed about your local regulations helps you avoid legal risks.

Understanding Bitcoin Tax Implications

Bitcoin is often treated as a taxable asset by tax authorities worldwide. This means:

- Capital Gains Taxes: Profits from selling or trading Bitcoin are generally subject to capital gains tax. The rate and reporting requirements depend on your country and the holding period.

- Income Taxes: Receiving Bitcoin as payment for goods or services usually counts as income and must be declared accordingly.

- Record-Keeping: Maintaining detailed records of all Bitcoin transactions—including purchases, sales, and transfers—is essential for accurate tax reporting and compliance.

Being aware of these regulatory and tax factors enables Bitcoin beginners to stay compliant, avoid penalties, and confidently participate in the cryptocurrency ecosystem worldwide. Always consult updated local regulations or a tax professional to ensure you meet your country’s legal obligations regarding Bitcoin.

Image courtesy of Engin Akyurt

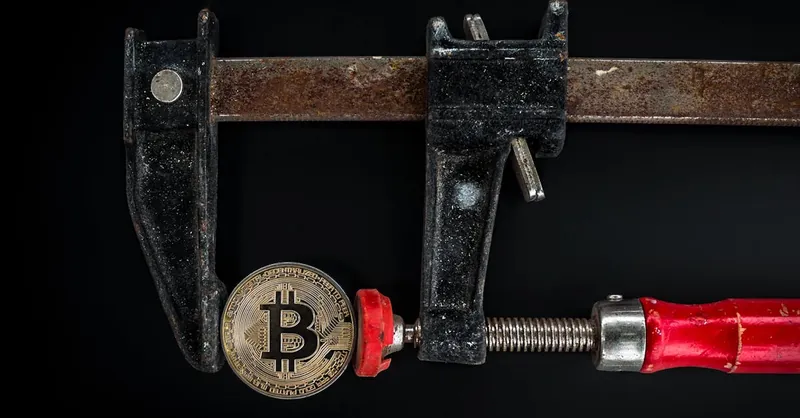

Risks and Rewards: Navigating Bitcoin Investment Challenges

Investing in Bitcoin offers significant rewards—from potential high returns due to its price appreciation and scarcity to its role as a hedge against inflation. However, beginners must be aware of the risks and challenges that come with Bitcoin investment to protect their assets and make informed decisions.

Common Risks in Bitcoin Investment

- Scams and Fraudulent Schemes: The cryptocurrency space is rife with scams including fake exchanges, Ponzi schemes, and phishing attacks targeting investors’ private keys and personal information. Always verify platforms and avoid offers that sound too good to be true.

- Phishing and Security Breaches: Hackers often use phishing emails, fake websites, or malicious apps to steal wallet credentials or seed phrases. Protect your accounts with strong passwords, two-factor authentication (2FA), and by only using trusted wallets and exchanges.

- Market Hype and Speculation: Bitcoin’s volatile price often attracts speculative trading driven by hype rather than fundamentals, which can lead to sharp downturns. Avoid impulsive buying or selling based solely on social media trends or “fear of missing out” (FOMO).

- Regulatory Uncertainty: Changing government regulations can affect Bitcoin’s availability, taxation, and legality, sometimes causing sudden market reactions that impact your holdings.

- Loss of Private Keys: Unlike traditional bank accounts, Bitcoin ownership depends entirely on control of private keys. If lost or stolen, your Bitcoin is irretrievable.

Tips to Minimize Risks While Maximizing Gains

- Educate Yourself Continuously: Stay updated on Bitcoin technology, market trends, and security best practices.

- Use Reputable Exchanges and Wallets: Opt for well-known, regulated platforms and hardware wallets to safeguard your funds.

- Diversify Your Investment: Avoid putting all your capital into Bitcoin alone; consider a balanced portfolio including other assets or stablecoins.

- Practice Strong Security Hygiene: Regularly update software, enable 2FA, double-check URLs, and never share your private keys.

- Set Realistic Expectations: Understand Bitcoin’s volatility and avoid chasing quick profits; adopt a long-term investment approach aligned with your risk tolerance.

- Verify Information Sources: Rely on credible news outlets, official announcements, and expert analysis rather than hype-driven social media posts.

By recognizing these challenges and applying prudent strategies, beginners can effectively navigate Bitcoin’s investment landscape—minimizing potential losses while positioning themselves to capitalize on Bitcoin’s unique growth opportunities. Responsible investing paired with robust security awareness transforms Bitcoin from a risky gamble into a viable component of your financial portfolio.

Image courtesy of Worldspectrum

The Future of Bitcoin and Its Role in Finance

Bitcoin’s future continues to generate immense interest as it increasingly shifts from a speculative asset to a foundational component of the global financial ecosystem. Several key adoption trends and technological upgrades are shaping how Bitcoin interacts with traditional finance, governments, and everyday users.

Growing Adoption Trends

- Institutional Investment: In recent years, large financial institutions, hedge funds, and publicly traded companies have embraced Bitcoin as a store of value and inflation hedge. This influx of institutional capital brings greater legitimacy and market stability.

- Corporate Payments and Treasury Reserves: More corporations are accepting Bitcoin as payment or holding it on their balance sheets, highlighting its potential as both a currency and a corporate asset.

- Global Remittances and Financial Inclusion: Bitcoin’s borderless nature makes it an efficient solution for cross-border payments and remittances, especially benefiting the unbanked and underbanked populations worldwide.

- DeFi and Layer 2 Solutions: Innovations such as the Lightning Network enable faster, cheaper Bitcoin transactions, unlocking new use cases including decentralized finance (DeFi) applications and microtransactions.

Technological Upgrades

- Taproot Upgrade: Implemented to improve Bitcoin's privacy, scalability, and smart contract functionality without compromising security, making the network more versatile for developers and users.

- Layer Two Scaling: Protocols like the Lightning Network enable instant, low-fee Bitcoin payments by conducting most transactions off-chain while retaining the security of the main blockchain.

- Interoperability Enhancements: Efforts to bridge Bitcoin with other blockchains and traditional finance aim to integrate Bitcoin seamlessly into wider financial infrastructures.

Bitcoin’s Evolving Role in the Global Economy

Bitcoin is positioning itself as digital gold, offering a decentralized alternative to fiat currencies amidst rising inflation and monetary uncertainty. Governments and central banks are closely monitoring Bitcoin’s growth, exploring how it might coexist or compete with emerging central bank digital currencies (CBDCs). Meanwhile, Bitcoin's censorship resistance and decentralized governance underscore its potential as a financial sovereign asset immune to geopolitical and institutional risks.

For beginners and seasoned investors alike, understanding these adoption dynamics and technological advancements is crucial for appreciating Bitcoin’s long-term value proposition. As Bitcoin matures, its integration into everyday financial systems and evolving regulatory acceptance will define its role in the future global economy and digital finance revolution.

Image courtesy of RDNE Stock project

Resources and Tools for Bitcoin Beginners: Stay Informed and Connected

Embarking on your Bitcoin journey is much smoother when you have access to reliable resources, tools, and communities tailored to beginners. Staying updated with the latest market trends, technological developments, and security best practices is essential to making smart decisions and avoiding common pitfalls. Here’s a curated list of trusted websites, apps, news sources, and online communities to help you learn, monitor, and engage confidently in the Bitcoin ecosystem.

Recommended Websites and Educational Resources

- Bitcoin.org

The original Bitcoin resource site provides clear beginner guides, wallet recommendations, and an in-depth FAQ to understand Bitcoin fundamentals and technical aspects. - Investopedia – Cryptocurrency Section

Offers comprehensive articles, tutorials, and explainers on Bitcoin, blockchain technology, and market dynamics, written in simple terms for all levels. - CoinMarketCap and CoinGecko

Essential platforms for tracking Bitcoin price data, market capitalization, volume, and historical trends, along with key statistics on thousands of altcoins. - Bitcoin Wiki

A community-driven encyclopedia covering all things Bitcoin and blockchain, perfect for deep dives into specific topics, terminology, and protocols.

Must-Have Apps and Wallets for Beginners

- Blockchain.com Wallet: User-friendly and highly secure for beginners, supports Bitcoin and other major cryptocurrencies.

- Electrum: A lightweight and trusted desktop wallet offering advanced security options for users ready to take more control.

- Blockfolio (now FTX App): Enables you to monitor your Bitcoin portfolio and receive real-time market alerts and news on your mobile device.

- Coinbase App: Ideal for beginners to buy, sell, and store Bitcoin seamlessly with an intuitive interface and built-in educational content.

Top News Sources for Accurate Bitcoin Updates

- CoinDesk and The Block: Leading crypto news outlets with breaking news, analysis, and expert opinions on Bitcoin markets, regulation, and technology.

- CryptoSlate: Provides up-to-date news, market data, and educational resources, focusing on blockchain trends and emerging projects.

- Bitcoin Magazine: One of the earliest dedicated Bitcoin publications offering thoughtful articles on Bitcoin’s technology, culture, and economics.

Engaging with the Bitcoin Community

Connecting with other Bitcoin enthusiasts and experts enhances your understanding and keeps you motivated. Consider joining:

- BitcoinTalk Forum: The oldest and most active Bitcoin discussion forum covering a broad range of topics from technical support to investment strategies.

- Reddit /r/Bitcoin: A highly engaged community sharing news, beginner guides, and open discussions on Bitcoin developments.

- Twitter Crypto Influencers: Follow well-known experts for real-time insights, market sentiment, and analysis.

- Discord and Telegram Groups: Many Bitcoin-focused groups offer live discussions, question-answer sessions, and networking opportunities tailored to beginners.

By leveraging these trusted resources and tools, Bitcoin beginners can build knowledge, track market movements, and join a vibrant community—all crucial steps to confidently navigating the exciting world of Bitcoin and cryptocurrency. Regularly engaging with reputable information sources helps you stay ahead in this rapidly evolving space while minimizing risks associated with misinformation or scams.

Image courtesy of Tima Miroshnichenko